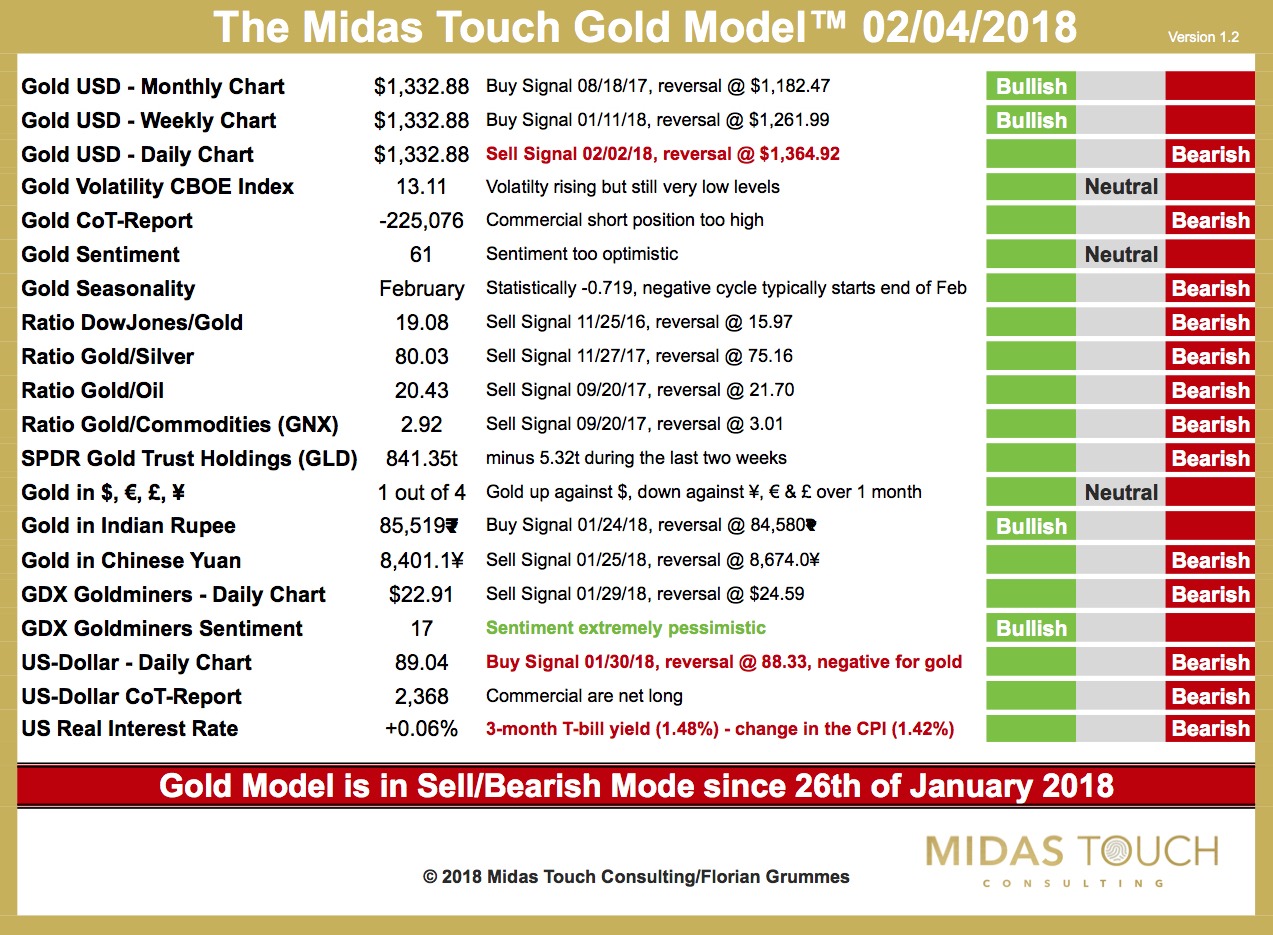

The Midas Touch Gold Model has shifted to a sell signal!

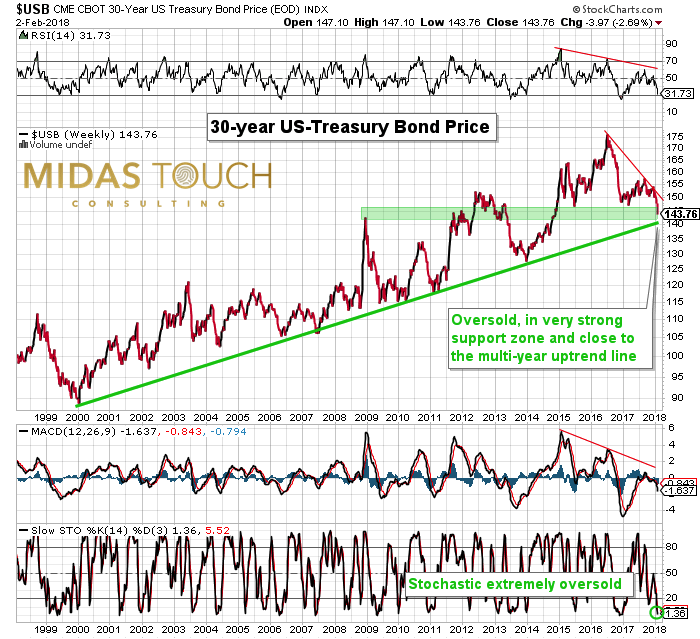

One of the most bearish signals came form the US Real Interest Rate which has turned positive for the first time in many years! The negative real interest rates have been one of the main arguments for gold. Yet over the last two months the 30-year US treasury bonds have sold off pretty sharply pushing interest rates higher.

Of course the daily and the weekly charts for the 30-year US treasury bonds are getting very oversold. At least a strong bounce is to be expected and might therefore lead to negative real interest rates rather soon again but in the bigger scheme of things this uptrend line should hold otherwise the era of negative real interest rates might be over!

As well we got clear sell signals from Gold in USD on the daily chart, Gold in Chinese Yuan on the daily chart and GDX Goldminers on the daily chart.

Looking at the new buy signal for the US-Dollar together with the fact that the professionals/commercials are net-long the US-Dollar we might see a bounce/recovery in the greenback which will hurt gold of course.

The only positive signal comes from the sentiment numbers for the GDX Goldminers which are extremely pessimistic. A short-lived recovery/bounce in the miners during next week is therefore very very likely.

Overall the model has a bearish conclusion and confirms our expectation that gold is on its way towards 1,285 – 1,310 USD over the next couple of weeks!