-

Market Update

Since mid of December the precious metals sector is in an uptrend. Especially gold has been acting very well while the mining stocks are basically consolidating since early February. After their phenomenal rally in the first half of 2016 they probably now need the confirmation of a higher gold price. At latest once gold can clear the 1,300 – 1,310 USD level they should start moving higher as well. I guess over the next one to three months we will get some great buying opportunities. Not at the lowest price probably but right in front of the next large move higher.

As you know I expect gold to move towards 1,500 USD by spring 2018. For silver the target sits around 26,00 USD. Both targets are the former strong support areas from 2011 to 2013. Also the falling wedge which gold left in early 2016 points towards 1,500 USD. At those levels gold and silver will be a sell and should start a multi month correction. but these levels are still far away and the gold bulls have a lot of work to do to reach those targets.

My only concern at the moment is the very oversold US-Dollar. Should the greenback start a bounce gold silver and the mining stocks might suffer for some weeks or even one to three months. Generally I currently believe that the Dollar has started a new bear-market as the whole world is participating in the witch hunt for Mr. Trump. Trump needs a weaker US-Dollar and the small rate hikes actually have been inflationary.Of course the booming cryptocurrencies are much more interesting these days as you could have made a fortune here by just simply buying into any of them. I am pretty sure that this is becoming a bubble but we are probably still at the beginning. I hope I can make a new recommendation here once the sector makes a pullback.

-

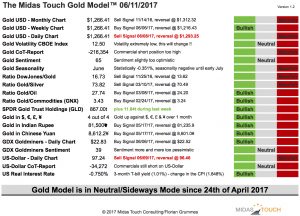

The Midas Touch Gold Model neutral since 24th of April 2017

The Midas Touch Consulting Report 06/08/2017 Gold Model

The Midas Touch Gold Model™ is in neutral mode since 24th of April 2017. Even though gold posted a strong rally over the last couple of weeks it was not enough to turn the model bullish.

The most positive development is the new bullish signal coming from the weekly chart but as long as the monthly chart as well as the gold/silver-ratio are bearish it will be difficult to get the model into a bullish conclusion.

Overall the model tells us to remain patient. If you want to see how the model acted over the last year click here. -

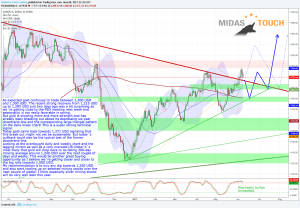

Gold – Buy The Next Dip Around 1,240 USD

The Midas Touch Consulting Report 06/08/2017 Gold

As expected gold continues to trade between 1,200 USD and 1,300 USD. The recent strong recovery from 1,215 USD up to 1,295 USD just two days ago was a bit surprising as we´re getting close to the FED meeting next week and seasonality is not really favorable in spring.

But gold is showing more and more strength and has already been breaking out above its depressing six-year downtrend-line and the corresponding large triangle pattern! This is a super strong technical signal. Today gold came back towards 1,271 USD signaling that this break out might not yet be sustainable. But today´s pullback could also be the typical test of the former downtrend-line.

Looking at the overbought daily and weekly chart and the lagging miners as well as a very oversold US-Dollar it´s most likely that gold will drop back to its falling 200-day moving average around 1,240 USD over the next couple of days and weeks. This would be another great buying opportunity as I believe we´re getting closer and closer to the big rally towards 1,500 USD.

My recommendation is to buy any dip towards 1,250 USD and also start loading up on selected mining stocks over the next couple of weeks. I think especially silver mining stocks will do very well later this year.

-

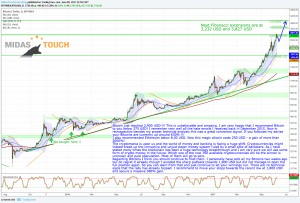

Bitcoin – Cryptomania Going Parabolic!

The Midas Touch Consulting Report 06/08/2017 Bitcoin

Bitcoin just reached 2,900 USD!!!! This is unbelievable and amazing. I am very happy that I recommend Bitcoin to you below 375 USD! I remember very well all the hate emails I received back in December 2015. Now in retrospective besides my proper technical analysis this was a great contrarian signal. If you followed my advise your Bitcoins are currently up around 630% !!!

I also recommended Ethereum below 8,00 USD. Now this magic altcoin costs 250 USD – a gain of more than 3000%!The cryptomania is upon us and the world of money and banking is facing a huge shift. Cryptocurrencies might indeed break up the corruptive and unjust paper money system ruled by a small elite of banksters. As I have stated many times the blockchain has been a huge technology breakthrough and I am very sure we will use some form of crypto money in the future. Which one of the now 700 available cryptocurrencies will be the winner is unknown and pure speculation. Most of them will go to zero.

But make no mistake. Although Cryptocurrencies are extremely volatile they are a great diversification. As with any investment you have to buy low and sell high. Right now is not the time to jump on board although the parabolic run-up in Bitcoin could continue for a couple more months and push all the other altcoins higher too.

My favorite cryptocurrencies are DASH and STEEM at the moment.

Especially STEEM looks still cheap. Steem is a blockchain-based social media platform where anyone can earn rewards for their content.

With DASH I like the unique features such as instant transactions (InstantSend feature), privacy and fungibility, incentivized infrastructure and the decentralized funding and governance. In fact, according to Reggie Middleton, DASH seems to have the best risk/reward-ratio of all cryptocurrencies!

Unfortunately DASH and STEEM have just seen a strong up move so I can not recommend to buy into the current strength. As soon as we get a reasonable dip I will send buy recommendations.Coming back to Bitcoin I think you should continue to hold them. I personally have sold all my Bitcoins two weeks ago but do regret it already though I avoided the sharp pullback towards 1,800 USD but did not manage to open the full position again. So you can learn from that and just continue to let your winnings run. There are no technical signs that the rally has already topped. I recommend to move your stopp towards the recent low at 1,800 USD and secure a massive 380% gain.