Bitcoin, how not to lose

With a twelve-month bull run from US$3,782 to US$58,352, it is easy to get complacent as a trader—one of the most dangerous places to be. No one could blame you if you were fortunate or skilled enough to catch some or all of this 1,443% advancement of Bitcoin and now feel a bit cocky. Unfortunately, in trading, you are always your own worst enemy. Losing sight of even the smallest amount of discipline can cause dramatic losses. Making money is the goal but risk control and holding on to your profits is even more critical. Bitcoin, how not to lose.

BTC-USD, Monthly Chart, Conservatively Bullish:

BTC-USDT, monthly chart as of March 8th, 2021.

One of the best ways to keep one’s emotions in check is reducing position size. It allows for accepting risk and, as such seeing the market for what it is. Looking at the monthly chart above, this size reduction on new entries is also in accordance with the risk at these more extended levels. We see prices progressing higher, but entry risk once the price has moved up this far aligns to our risk control parameters from a psychological perspective and a statistical one.

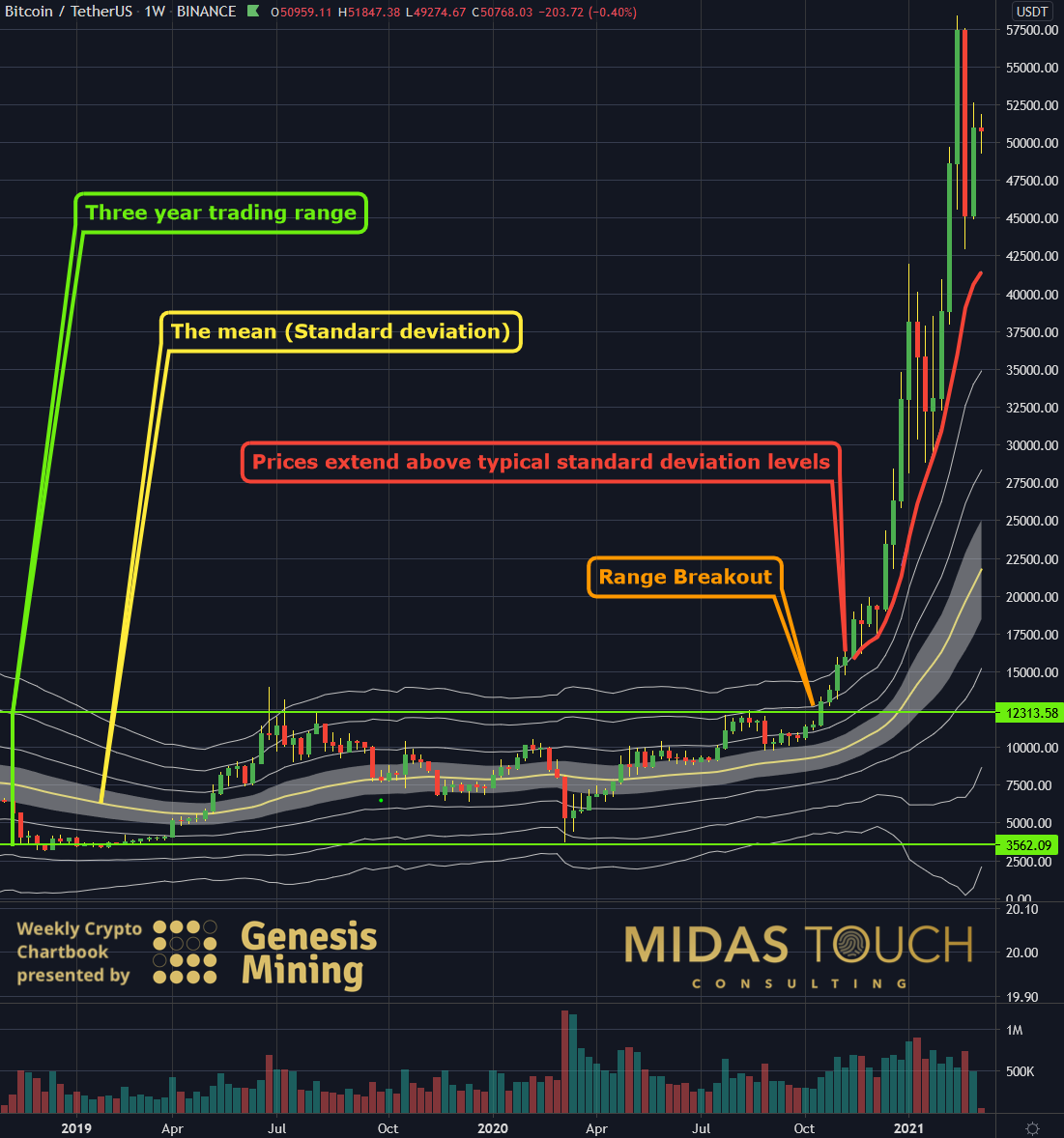

BTC-USDT, Weekly Chart, Steep and steady:

BTC-USDT, weekly chart as of March 8th, 2021.

This weekly chart shows price behavior even more clearly. For nearly three years, Bitcoin prices meandered around the mean (yellow line). Last year in October, Bitcoin prices broke out of this range. Already four weeks later, in November 2020, prices extended above typical standard deviation levels. Nothing atypical for Bitcoin, which loves sharp advances. And again, we do not see prices decline from here rapidly. However, what is affected are stop levels and entry probabilities, which makes the astute trader behave more risk-averse both in exposure size and trading frequency.

BTC-USDT, Daily Chart, Bitcoin, how not to lose:

BTC-USDT, daily chart as of March 8th, 2021.

The green arrows on the daily chart show our long entries last week. We posted these in real-time in our free Telegram channel. Each of these entries had a position size reduced by thirty-five percent. We were also able to finance all three trades (=take partial profits shortly after entry based on our Quad exit strategy to eliminate risk). For now, we are holding remainder small position sizes for possible price advances without a skewed view due to the more than usual conservative approach (= minimal position size).

Bitcoin, how not to lose:

It takes quite some experience to judge oneself on emotions of over- self-confidence. If you had an excellent run on investments, take some money off the table. Wire it from your brokerage. Consider self-gifting, vacation, or otherwise reward yourself. Make sure your daily self-assessment routine contains this checkpoint of possible over-confidence. Reduce size for upcoming trades and pat yourself on the shoulder for a job well done.

You could give more considerable amounts of profits up due to negligence and being complacent, not abiding as diligent to your trading rules, as usual. This can be especially painful in these heightened emotional states. Consequently, this causes even more dramatic setbacks trying to brush early warning signals of over trading and under-selecting signal quality off and trying to prove yourself. Like the market, you need to take a breath, celebrate, and return light footed on half size for the next run-up.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.