Physical versus digital money

Since about one year we are living in a world where negative stories dominate nearly every conversation. News are negative since drama sells better, but a pandemic instills fear for your life. Typically, we had a balance. We also talked about parties, weddings, travels – social joyful interactions. Now we are a bit frightened, which likely will increase as the winter season provide more negative pandemic data. A scared population is much easier manipulated into change. Change that otherwise would be controversial and would take a lot longer to implement. If the government offers a free stimulus package paid out in digital money, its subjects would not object to such free money and quickly sign up with their phones to receive such a payment. In times of need, no one questions the long term effects of such a radical introduction of a possible shift from physical fiat currency to a digital money system. Physical versus digital money.

There will always be a demand for rare physical precious metals. They have inherent value in their application to our daily life. We need Gold for dentistry and medicine, Silver for electronics, Platinum in the automotive industry, Cesium for 5G, and so forth.

We won’t give up on making jewelry and have used Gold and Silver for nearly 2,700 years as means of barter.

The question is, will it be sufficient as a backup plan to store wealth in physical tangibles alone?

We dare to argue that it won’t. If one government should decide to go digital, most likely other governments will follow. Soon we will find ourselves in a world fully transparent and without privacy. You might still be able to purchase gasoline with a silver coin or a hog at your farmer in Gold. Still, an even remotely long-distance transaction would become a hurdle. Bitcoin, in our humble opinion, inherently not controlled, and limited in its supply, might take a different role should governments opt for a digital currency of their own.

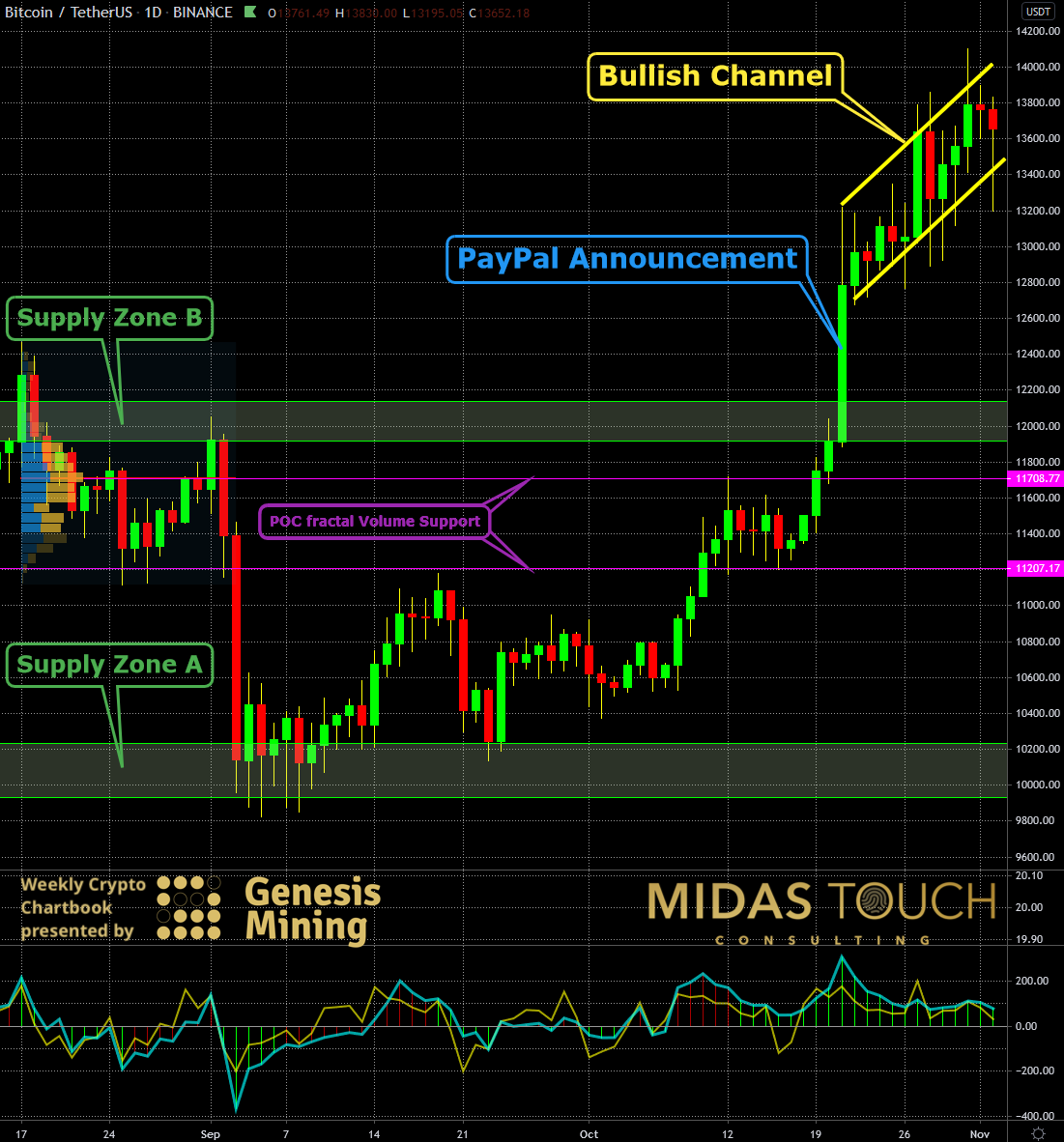

BTC-USDT, Daily Chart, Bullish as can be:

BTC-USDT, daily chart as of November 2nd, 2020

PayPal’s news release and its effect on the market, that it launches its cryptocurrency service in 2021, confirms in part our statement. This news release on October 21st made Bitcoin advance at one point by more than 11% intra-day. Significant resistance zones were broken, which turned now into Supply zone B. The hope for mass adaptation brought excitement to the bitcoin community.

Looking at the daily chart above we see nothing but strength. The 10k level (Supply zone A) is cemented with additional support levels above. In the two weeks following PayPal’s announcement all attempts of a retracement have failed. Instead, a bullish directional channel has formed.

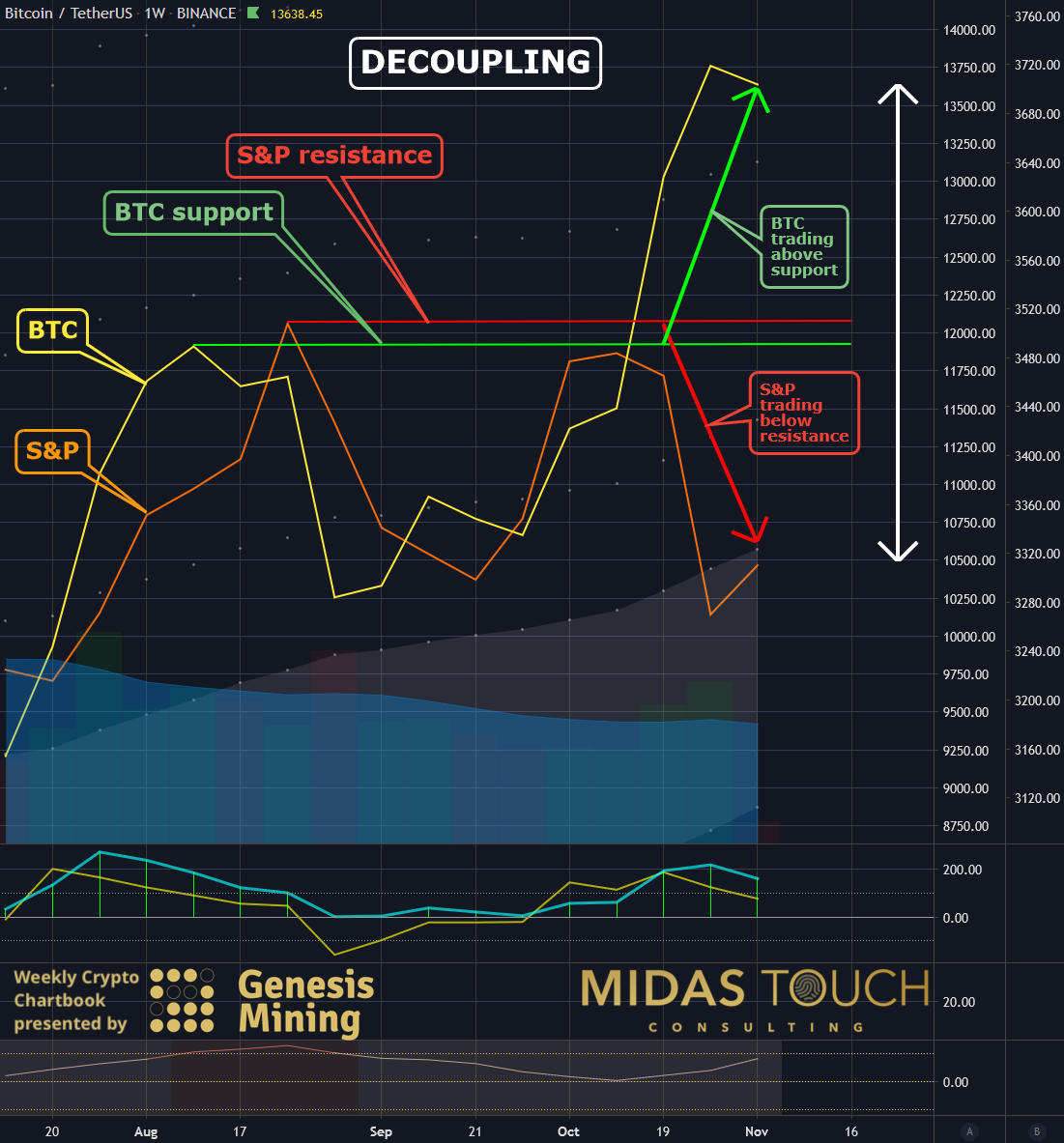

BTC-USDT, Daily Chart, Decoupling:

BTC-USDT, daily chart as of November 2nd, 2020 b

Furthermore, you can see that Bitcoin decoupled from the markets. It stands on its own now and is more bullish than any other major market component out there.

BTC-USDT, Monthly Chart, Simple Wins:

BTC-USDT, monthly chart as of November 2nd, 2020

The most important view is always the larger time frame. We purposely kept this chart simple. Pushing now for the third time against resistance (14k zone) and as such weakening this hurdle, we see a good likelihood of a further price advance. Healthy volume figures support that view.

We could have used the word “president” or “elections” in our headlines to aim for maximum marketing effect, but at Midas Touch Consulting, we stay true to our main goal: principle-based advice on how to protect Your money. Sensationalism (some named these elections “the most important elections in the history”) is typically not what helps the individual. Zooming out and bringing into focus today’s topic, is hopefully true value for your abundant future. This especially in the year 2020, which is littered with sensationalized news.

Physical versus digital money

We are not saying you should transfer all your fiat currency. Neither are we speculating on how the new world looks in detail. We live in times so quickly transforming that we might find ourselves in a future of all kinds of shapes and forms. As traders and wealth preservation consultants we are merely playing the odds to ensure the best placement of your monies to protect your assets. In our humble opinion, you will need both. You will need physical and digital means to make your purchases. Bitcoin seems a good stronghold to protect your free barter in a privacy-protected way to ensure your freedom to make choices that you see fit.

We post real time entries and exits for many cryptocurrencies in our free Telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.