Powell’s Words Unsettle Markets

For the second time this year, the U.S. Federal Reserve has lowered its key interest rate, although the decision was more cautious than expected. Despite persistently high inflation, the Fed sees growing risks in the labor market and is responding with another round of monetary easing. The benchmark rate was cut by 0.25 percentage points to a range of 3.75–4.0 percent. Gold & Silver – Powell’s Words Unsettle Markets.

This move did not surprise the markets, but Fed Chair Jerome Powell unsettled investors during the subsequent press conference when he remarked that another rate cut in December was “anything but certain.”

Labor Market in Focus – Data Missing Due to Shutdown

The Federal Reserve justified its latest rate cut by pointing to increasing risks to employment and growth. The ongoing government shutdown in the U.S. is straining the labor market since key economic data are missing or being published with delays. There is no end in sight to the budget impasse, and the financial damage has already added up to billions of dollars.

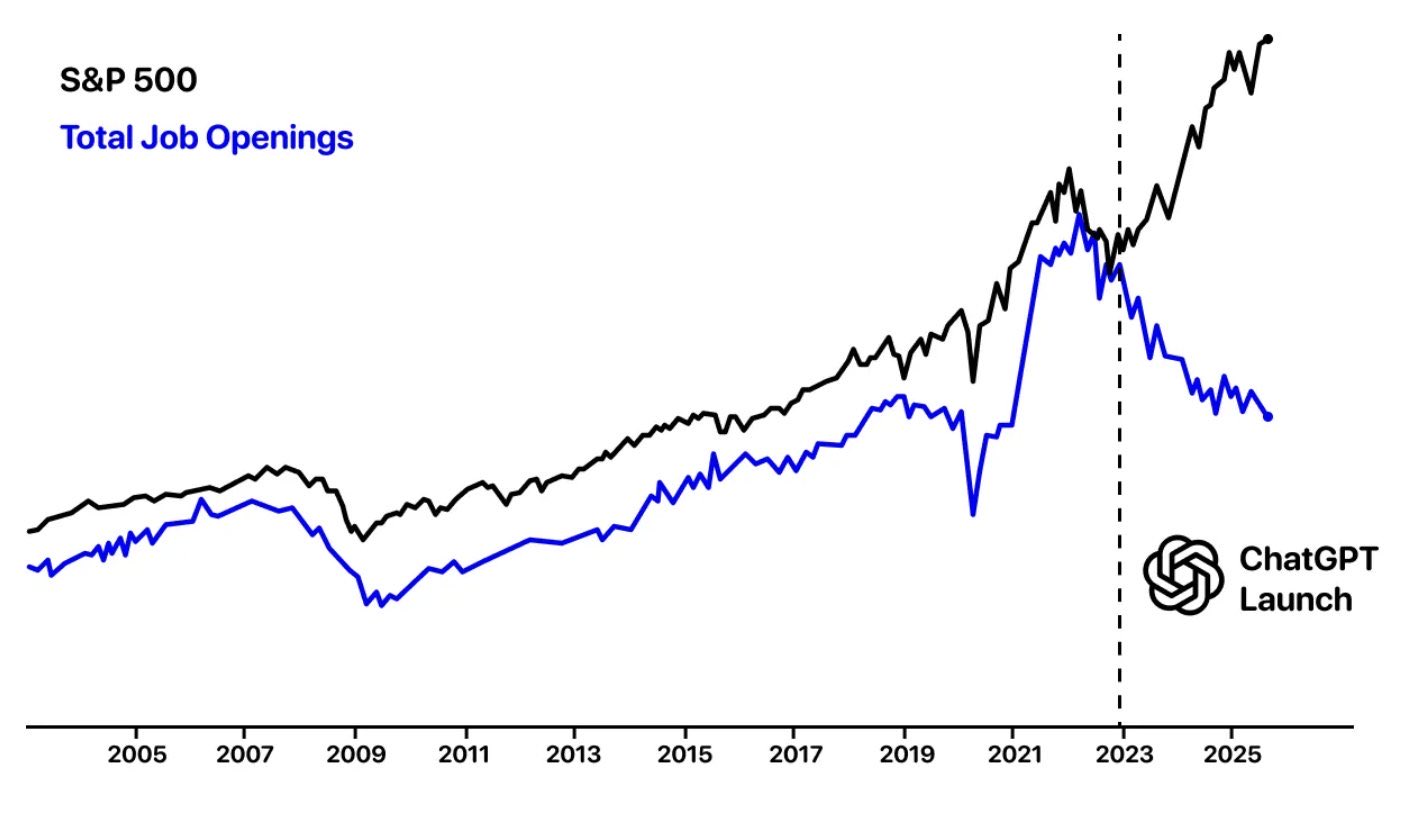

S&P500 Total Job Offerings, as of October 30th, 20205. ©Simon Dixon

Some analysts also argue that artificial intelligence, particularly since the launch of ChatGPT, has been putting considerable pressure on the U.S. labor market.

Inflation Takes a Back Seat

Following the rate decision, the U.S. dollar strengthened significantly, weakening the euro—a development unwelcome to President Trump, who views a weaker U.S. currency as beneficial for exports and tourism.

Trump’s Growing Influence Over the Fed

Although the Supreme Court has temporarily halted his attempt to dismiss her, questions linger about how independent the Federal Reserve can remain under growing presidential pressure.

Powell’s hawkish tone during the press conference dampened market sentiment. While stock indices such as the S&P 500 and Dow Jones initially hit new record highs, they reversed course later in the evening and closed mixed. The U.S. dollar, however, benefited from Powell’s comments.

Gold Price Slips Below USD 4,000

Gold in US-Dollar, daily chart as of October 30th, 2025. ©Gold.de & Midas Touch Consulting

The gold price, which has been in a consolidation or correction phase for nine days after reaching a new all-time high of USD 4,380, lost its footing above the USD 4,000 mark and fell sharply back to USD 3,930 by the market close.

Silver showed a similar pattern, although it held up somewhat better compared to gold.

In Asian trading on Thursday, gold saw a slight rebound: starting from a small double bottom at USD 3,915, prices climbed again in the morning. After a volatile session gold will close aboe the psychologically important USD 4,000 threshold.

Nevertheless, the rally that began at the USD 3,880 low on Tuesday remains on shaky ground. After a USD 500 decline within just one week, the oversold daily chart hints at a possible countertrend move, but the gold market still appears fragile and uncertain.

A sustainable recovery will likely take more time until market confidence returns. The next crucial step would be a lasting move back above USD 4,000. If that happens, further recovery targets would be around USD 4,050 to USD 4,070 and about USD 4,200.

Silver Reaches Target at USD 46.80

Since hitting its new all-time high of USD 54.51 (intraday) on October 17th, 2025, silver has corrected sharply, falling 16.4 percent. Our minimum target from the head-and-shoulders top pattern at USD 46.80 was reached within just four trading days. The correction low was recorded last Tuesday at USD 45.55.

A recovery has since begun, showing moderate stability and already advancing to $48.97. The first recovery target has been met. The next one is waiting around USD 51.10. Below USD 46, however, the correction would likely continue.

Conclusion

After the sharp pullback, precious metal prices are attempting to stabilize and recover. However, gold in particular is struggling to regain its momentum.

The stronger U.S. dollar is adding to the headwinds. Over the coming days, a continuation of the recovery appears more likely, provided that gold defends its key support zone between USD 3,880 and USD 3,930 and avoids retesting it.

From a broader perspective, all recovery attempts in the gold market below USD 4,380 are considered interim rallies. The ongoing correction phase could therefore extend into mid-December.

Analysis initially published on October 30th, 2025, by www.gold.de. Translated into English and partially updated on October 31st, 2025.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals, commodities, bitcoin and cryptocurrencies, you can also subscribe to our free newsletter.

Disclosure: This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.