ETH/BTC priming for a bounce?

Bitcoin has taken the spotlight in recent weeks, as the top dog cryptocurrency surged to all time-high territory in just 2 months of parabolic price-action. However, Ethereum has gained some ground in the past few days, suggesting that a temporary market dynamic change could be in the works. ETH/BTC priming for a bounce?

Specifically, Bitcoin and Ethereum tend to take turns in propelling the crypto industry forward. From May to August, for example, Ethereum led bitcoin in both performance and price-action; and during this latest run-up to all-time highs, the reverse was true.

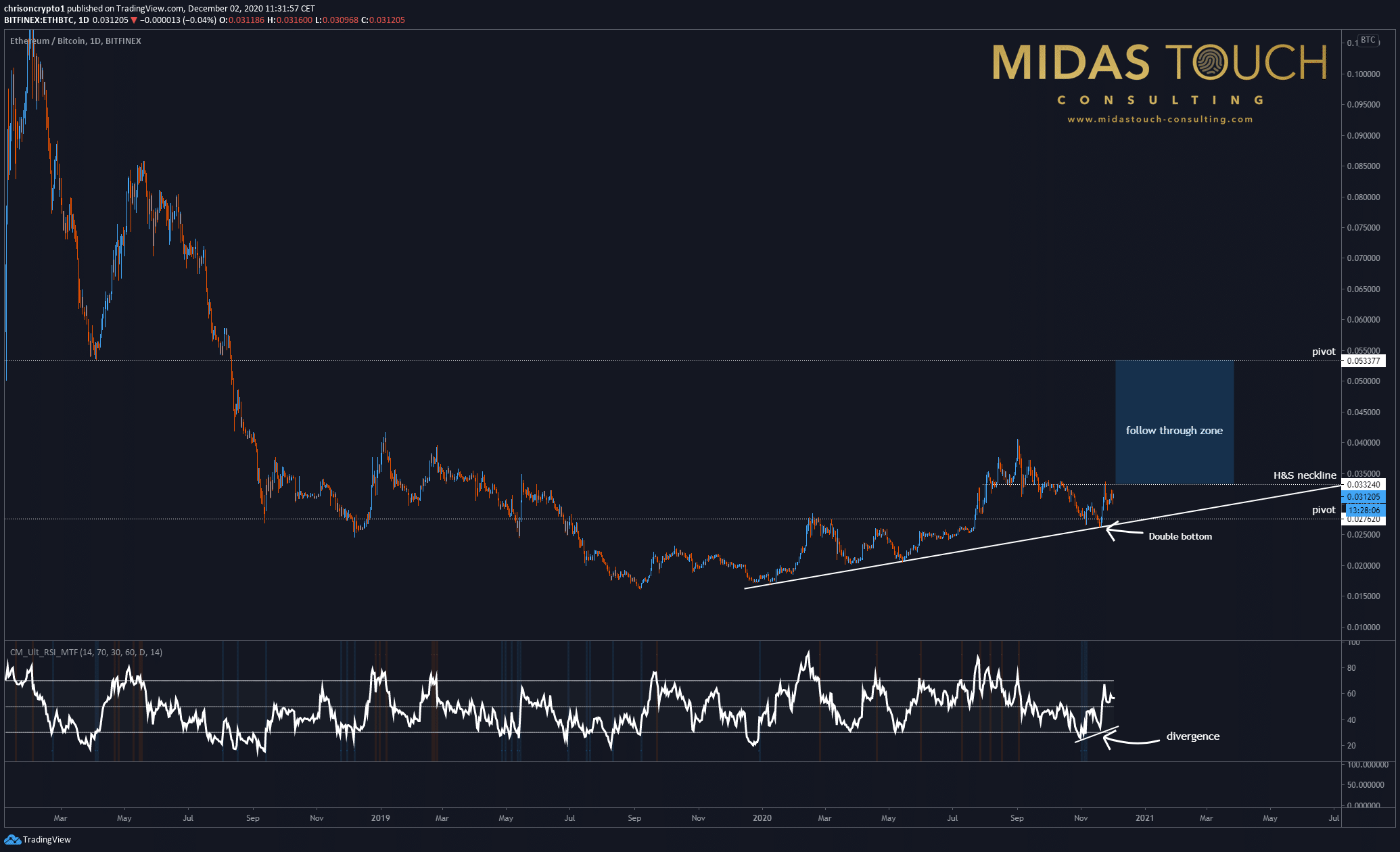

As noted in mid-November, the Ethereum-Bitcoin chart neared a crucial make-or-break pivot point on which price bounced spectacularly. A series of confluent factors and technical indicators suggested that this move was likely and it played out quite well.

By and large, the 0.02780 Satoshi level has been a long-term pivot point that denoted bear and bull trends in the ETH/BTC pair. In this case, the upwards trending support line provided structural support while the Relative Strength Index (RSI) showed decreasing sell-side pressure with a clear bullish divergence on the daily time-frame. Finally, the move was compounded with a double-bottom structure.

ETH/BTC priming for a bounce?

Bitcoin has taken the spotlight in recent weeks, as the top dog cryptocurrency surged to all time-high territory in just 2 months of parabolic price-action. However, Ethereum has gained some ground in the past few days, suggesting that a temporary market dynamic change could be in the works. ETH/BTC priming for a bounce?

Specifically, Bitcoin and Ethereum tend to take turns in propelling the crypto industry forward. From May to August, for example, Ethereum led bitcoin in both performance and price-action; and during this latest run-up to all-time highs, the reverse was true.

As noted in the telegram channel in mid-November, the Ethereum-Bitcoin chart neared a crucial make-or-break pivot point on which price bounced spectacularly. A series of confluent factors and technical indicators suggested that this move was likely and it played out quite well.

By and large, the 0.02780 Satoshi level has been a long-term pivot point that denoted bear and bull trends in the ETH/BTC pair. In this case, the upwards trending support line provided structural support while the Relative Strength Index (RSI) showed decreasing sell-side pressure with a clear bullish divergence on the daily time-frame. Finally, the move was compounded with a double-bottom structure.

The question on everyone’s mind now is: will there be follow through?

Given the significance of this bounce and historical evidence, it’s reasonable to think this. A sustained break above the head and shoulders neckline could provide fresh impetus to push Ethereum outside the 0.02-0.038 Satoshi trading block towards the next macro pivot point at 0.05337 Satoshis. This could take several weeks to months.

Failing that, then investors looking for short term upside might aim to enter on a final retest of the upwards sloping support above 0.027620 satoshis. In the event that the floor doesn’t hold, then Ethereum and many alt-coins will probably witness a bloodbath of epic proportions. However, bearing in mind that Ethereum has yet to reach its all time high in USD terms, the prospect of another ‘leader’ flip isn’t at all far-fetched. Indeed, Ethereum is still 124% away from it’s all time highs, and a rising tide lifts all boats.

The BTC-ETH debate rages on

Heated debates about Bitcoin and Ethereum continue to rage all over the internet, and will probably continue for some time to come. Just like Amazon and Ebay competed neck and neck for years, the same could be true of Bitcoin and Ethereum, both of which are optimised for advancing different principles. While we will not debate the vices and virtues of each cryptocurrency, it’s safe to say that this discussion will continue on for the foreseeable future, and it will ultimately be reflected in the charts.

Today, the trend is clear: Bitcoin is king and Ethereum is second in command. However, there’s no doubt that competition between the two will continue on multiple fronts. Of course, Bitcoin has much more gunning for it, but ethereans are almost as persistent as bitcoiners in their alleged quest to change finance.

Eventually, time will lay it all out to bear. In the meantime, place your bets!

We post real time entries and exits for Bitcoin and crypto-assets in our free Telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.

Author Credit: Christopher Attard, journalism and content specialist who covers bitcoin and crypto markets.

Get in touch at contact@chrisoncrypto.com and https://chrisoncrypto.com for more info.