Palladium – Manageable Remaining Risk

Overall, precious metal prices have remained under pressure in the last two months. In the wake of the ECB’s next interest rate hike (+0.25%) and persistent US inflation data, gold temporarily fell back to the psychological mark of USD 1,900 as of last week Thursday afternoon where new buyers started to show up. Silver and platinum also couldn’t escape the recent selling pressure but have recovered together with gold over the last three trading sessions. Palladium – Manageable Remaining Risk.

As the correction has been slow and sluggish since early May, the anticipated breakout to new all-time highs in the gold market is likely being postponed to next year. Seasonally, the gold price has generally struggled between early September and mid-December over the last 12 years. However, it tends to start a new upward trend after the last FOMC meeting on December 12th and 13th, 2023. as it begins to factor in a turnaround in US monetary policy due to the weakening economic situation, similar to the measures taken in March due to escalating market disruptions.

If, before that, rescue measures become necessary, similar to what happened in March due to escalating market disruptions, the current mixed picture could quickly turn bullish within a few days.

Palladium has been correcting since March 2022.

Palladium, the exotic among the four precious metals, has been trapped in a correction for a considerably longer time. It has been in a relentless downtrend since March 7, 2022. Prices have lost over 65% from the all-time high reached back then at around USD 3,434. Consequently, the situation on the monthly and weekly charts is deeply oversold. With prices around USD 1,260, there isn’t much further to go until the strong support level around USD 1,155.

Unique properties and extraordinary capabilities

Regardless of this harsh correction, palladium remains an indispensable element in our modern world and finds diverse applications in various industries due to its unique properties. Its exceptional ability to absorb and store hydrogen has made it a crucial component in the development of hydrogen fuel cells, promising a cleaner and more sustainable energy future. Furthermore, palladium’s catalytic capabilities have revolutionized the automotive sector by facilitating the conversion of harmful emissions into less harmful substances, significantly reducing air pollution and improving air quality.

In addition to its central role in energy and environmental technology, palladium also plays a crucial role in the electronics industry, serving as a key material in the production of capacitors, sensors, and various other electronic components. Its high electrical conductivity and exceptional corrosion resistance make it an ideal choice to ensure the reliability and durability of electronic devices. Moreover, palladium’s role in the jewelry industry cannot be overlooked, as its shiny, white appearance has captured the hearts of many and created a unique niche in the world of precious metal jewelry.

85% of the demand comes from the automotive industry

Overall, the global total demand is composed of automotive catalysts (85%), electronics and electronic components such as capacitors (10%), and jewelry and jewelry manufacturing (5%).

15 times rarer than platinum

Geologically, palladium is considered a relatively rare element in the Earth’s crust. Its weight proportion in the Earth’s crust is estimated at about 0.015 parts per million (ppm). In comparison to these natural occurrences, palladium is approximately 15 times rarer than platinum and even about 30 times rarer than gold! Only rhodium and iridium are even rarer.

Russia and South Africa together supply two-thirds of the production

In 2021, a total of approximately 232 tonnes of palladium were produced worldwide, with Russia contributing 82.3 tonnes (35.4%) and South Africa providing 74 tonnes (31.8%), together accounting for 67.4% or two-thirds of the supply. Other countries, such as Canada (19.4 tonnes), the United States (15 tonnes), and Zimbabwe (13 tonnes), also contribute to global palladium production but to a significantly lesser extent.

A somewhat ambivalent fundamental outlook

In summary, the price of palladium is heavily dependent on demand from the automotive sector, particularly in gasoline-powered vehicles. The shift towards electric vehicles without internal combustion engines has led to a decline in palladium demand and EV adoption remains the biggest threat to palladium. Additionally, a significant deterioration in the worldwide economy (e.g. recession) could further suppress demand.

On the other hand, the very limited supply is primarily coming from two countries. While Russia is geopolitically isolated from the West, palladium mining in South Africa faces numerous significant challenges, including safe working conditions at deep mining depths, increasing resource exhaustion, rising energy costs, and regular power outages.

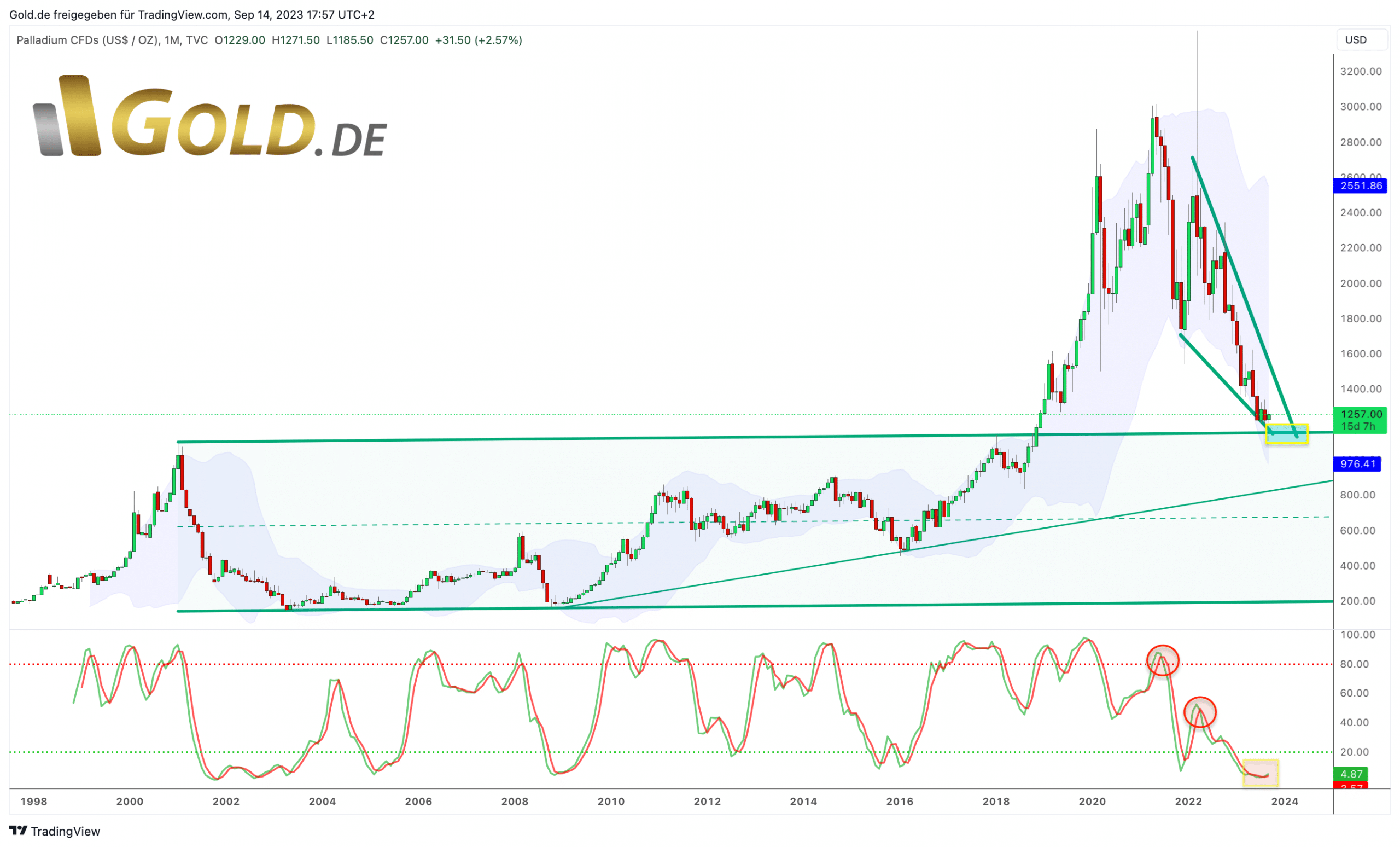

Palladium in US Dollars – Monthly chart with strong support at USD 1,150

Palladium in US-Dollar, monthly chart as of September 14th, 2023. Source: Midas Touch Consulting & Gold.de

Technically, the price of palladium has been in a sharp correction since March 2022. Prior to that, prices had risen almost continuously for nearly 14 years, starting from the fall of 2008, by a total of nearly 2,060%. The uptrend accelerated only after breaking through USD 1,150 in November 2018. The COVID-19 crash caused an initial sharp pullback in February and March 2020. However, palladium prices reached a new all-time high afterwards, only to halve within six months.

The latest bullish chapter began in mid-December 2021 with lows around USD 1,528. When Russia invaded Ukraine at the end of February 2022, palladium prices shot up by over USD 1,000 within a few days, starting from around USD 2,300. Finally, a new all-time high was reached at USD 3,440 on March 7th. However, this led to a sharp trend reversal to the downside, and prices have since fallen to a low of USD 1,185 on July 10th, 2023. While palladium has struggled to recover, the recent two-month price action could also indicate a bottoming process.

Of particular interest in the broader picture is the old and flat uptrend channel, which influenced price movements until November 2018. Currently, its upper boundary in the USD 1,150 area provides strong support. Coupled with the highly oversold stochastic oscillator on the monthly chart, palladium is expected to turn upwards at that point. Subsequently, a lucrative recovery to levels around USD 1,700 and USD 2,000 is conceivable.

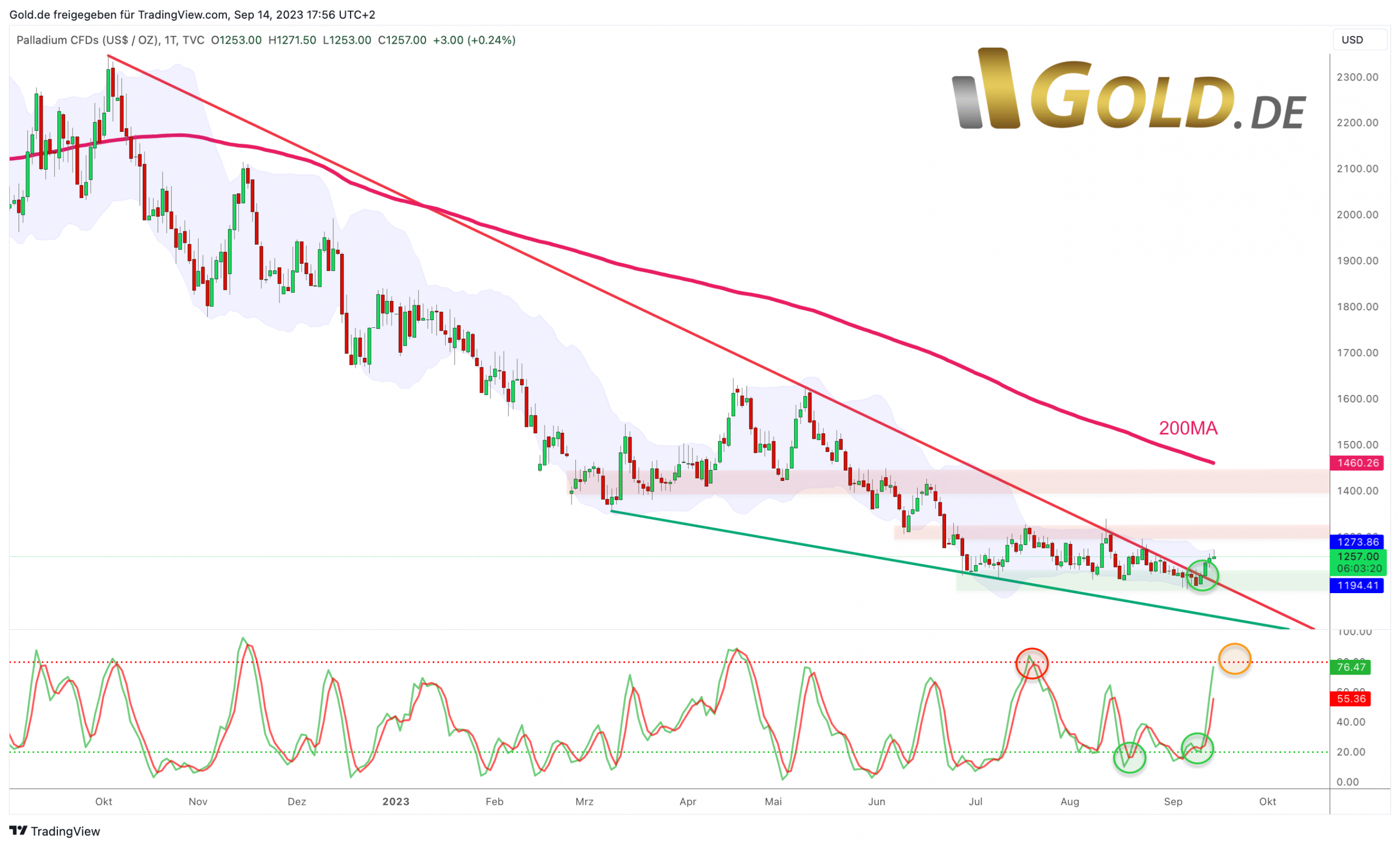

Palladium in US Dollars – Daily chart with a breakout above the downtrend line

Palladium in US-Dollar, daily chart as of September 14th, 2023. Source: Midas Touch Consulting

On the daily chart, the trading week witnessed a breakout above a downtrend line that has been capping prices since October 2022. Combined with the consolidation of the past two and a half months, signals for a potential trend reversal are strengthening. Although the upper Bollinger Band is currently providing short-term resistance at USD 1,277, the next resistance zone only begins at USD 1,345. Even more room for an extended recovery is offered by the rapidly descending 200-day moving average (USD 1,460).

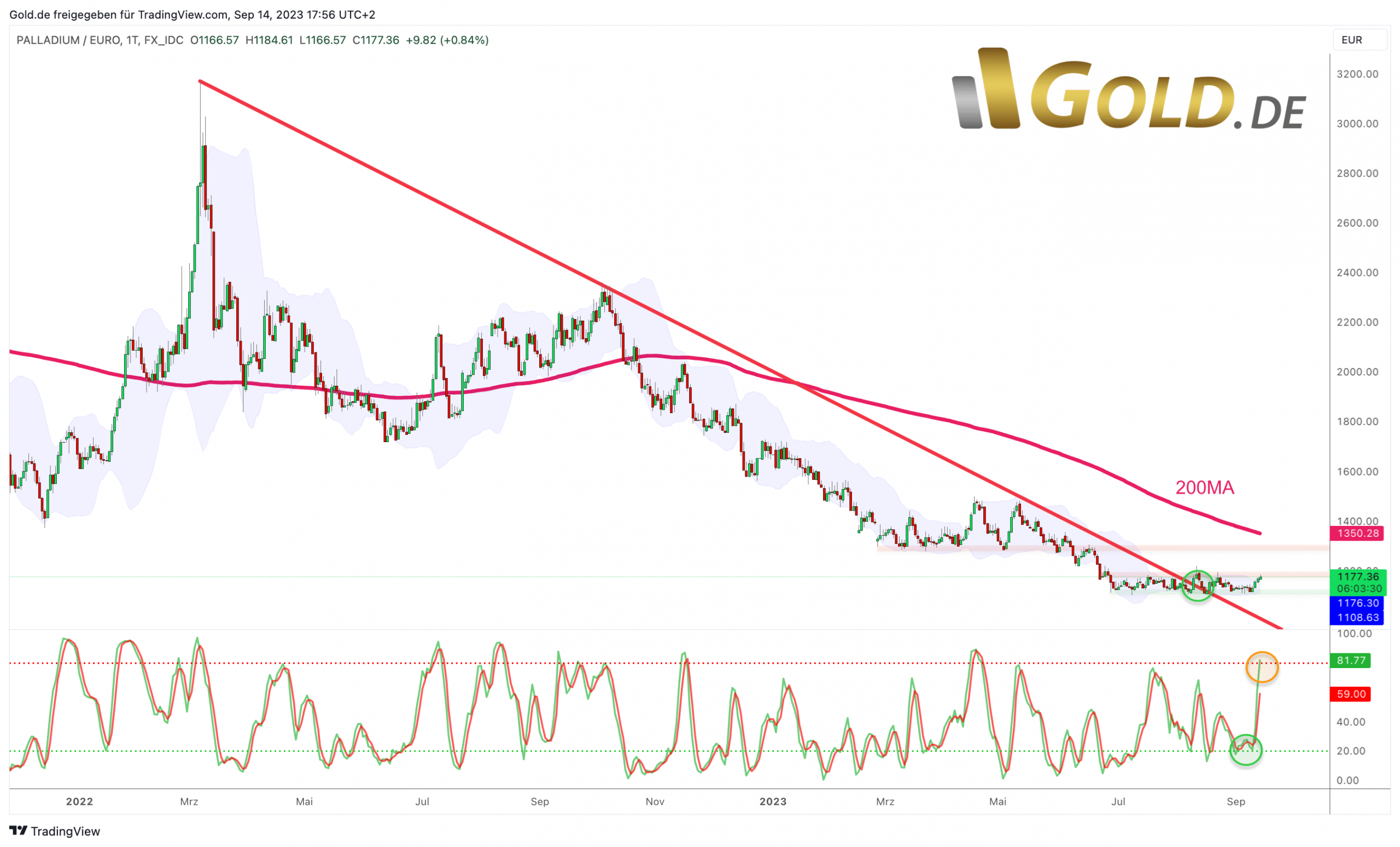

Palladium in Euro – Dollars – Buy Limit at Euro 1,160

Palladium in Euro, daily chart as of September 14th, 2023. Source: Midas Touch Consulting

In terms of Euros, the correction in the palladium market has been dramatic since March 2022, too. However, the situation stabilized with a low at EUR 1,101 on July 10th. Since then, prices have been moving sideways since then. In fact, similar to palladium in US Dollars, the upper boundary of an old uptrend channel is present in the EUR 1,125 to 1,135 range. Therefore, the current consolidation and stabilization around these price levels are not surprising.

Overall, palladium would need to rise by nearly 15% to reach its rapidly falling 200-day moving average (EUR 1.350). The slightly overbought Stochastic indicator and the upper Bollinger Band at EUR 1,175 advise patience in the short term, though. We are setting a buy limit at EUR 1,160.

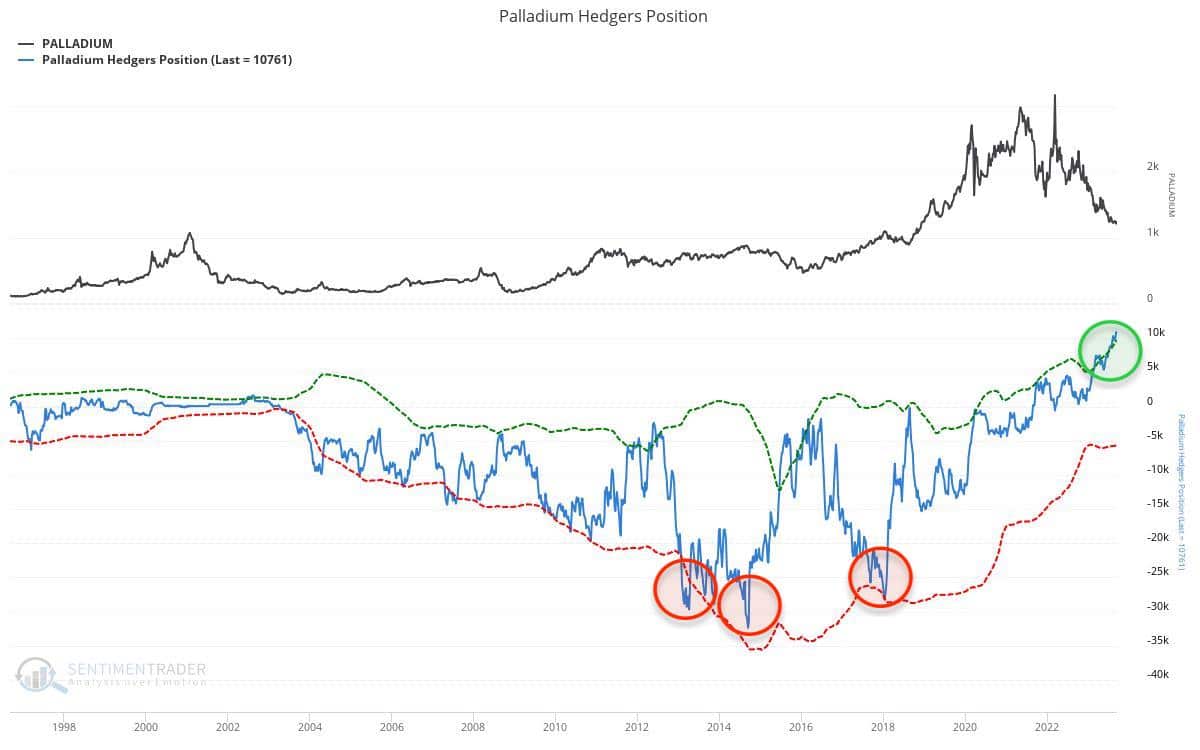

Commitments of Traders for Palladium – Extremely Bullish

Commitments of Traders (COT) for palladium as of September 12th, 2023. Source: Sentimentrader

According to the latest CoT report based on data from September 12th, commercial hedgers are cumulative net long by 10,761 contracts. This is historically unprecedented and extremely bullish. In a long-term comparison, never has the professional money held a larger long position, hence betting on rising palladium prices.

The current CoT report is extremely bullish and gives a very strong contrarian buy signal.

Conclusion: Palladium – Manageable Remaining Risk

The price of palladium has been severely punished over the past one and a half years. Considering the rather manageable remaining risk to the downside (very strong support around USD 1,150) and the bottoming process since early July, palladium now appears to be an interesting contrarian opportunity. However, one should not be too rigid with purchase price limits. Over the next two years, a recovery could easily bring prices in the range between USD 1,700 and USD 2,000.

Analysis initially published on September 15th, 2023, by www.gold.de. Translated into English and partially updated on September 16th, 2023.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies, you can also subscribe to our free newsletter.

Disclosure: This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.