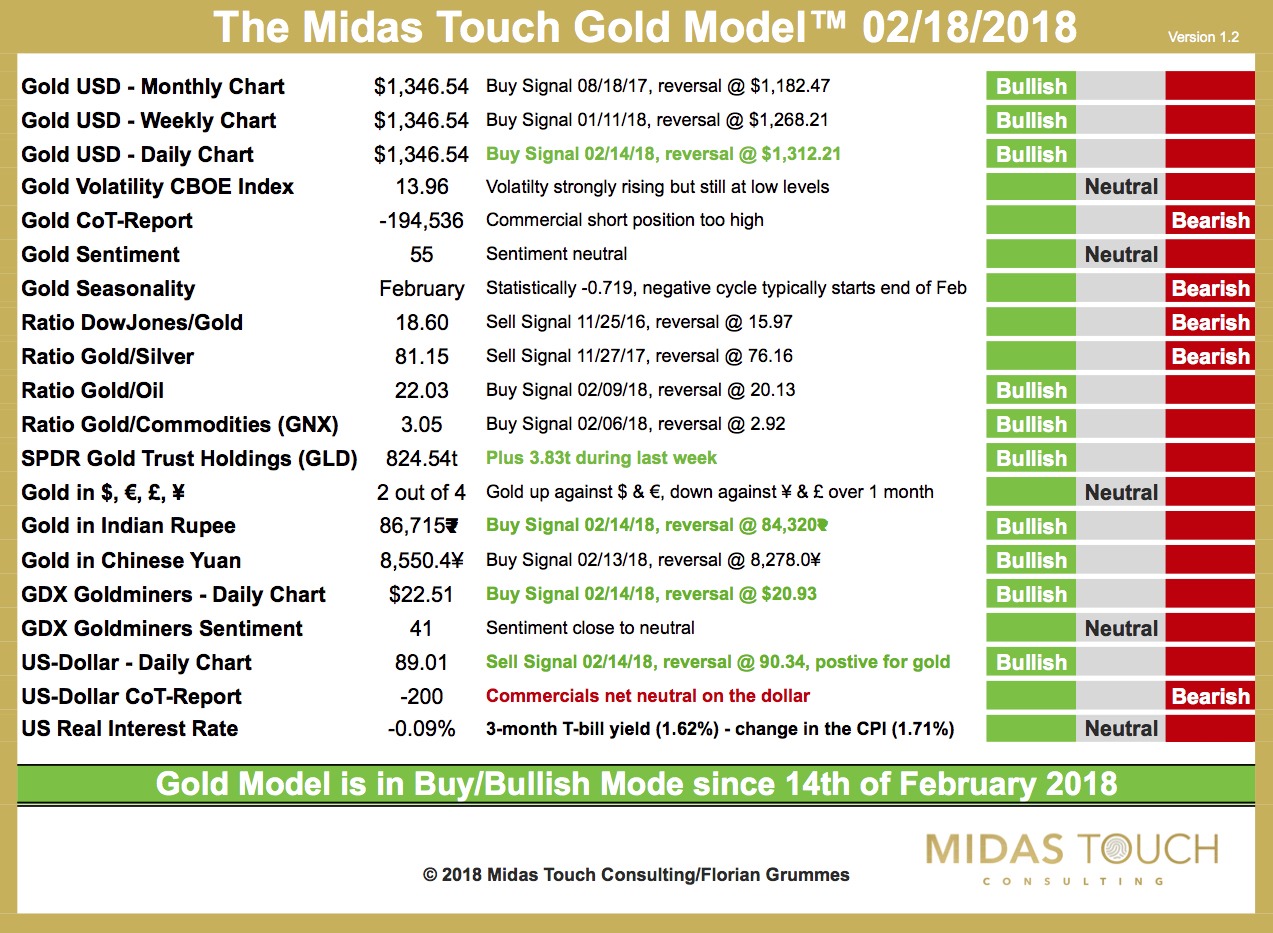

The Midas Touch Gold Model™ is in bullish mode since 14th of February 2018!

With gold´s strong rally last Wednesday the Midas Touch Gold Model™ immediately shifted to a new buy signal!

Responsible for this transformation were new buy signals from Gold USD Daily Chart, Gold in Indian Rupee, GDX Daily Chart and of course a new sell signal for the US-Dollar which is bullish for gold. Besides that the SPDR Gold Trust (GLD) got 3.83 tonnes of gold flowing into its inventories.

On the negative side there is only a new bearish signal coming from the US-Dollar CoT-report as the commercials players basically reduced their US-Dollar short position to neutral. In the bigger picture this is a very bullish positioning for the US-Dollar yet short-term the US-Dollar remains under pressure!

And finally due to the rising CPI-number the US Real Interest Rate is back into negative territory.

All in all the Midas Touch Gold Model™ is bullish.