Gold – Euphoria, Crash, Consolidation

Gold has surged from USD 4,180 to a record USD 5,602 in early 2026 amid euphoric rallies fueled by geopolitical tensions and safe-haven demand, only to crash sharply to USD 4,402 before consolidating around USD 5,000—exemplifying classic speculative cycles within a secular bull market. This analysis dissects the technical pullbacks, futures positioning, sentiment shifts, seasonality, and macro drivers like China’s gold stockpiling and global power realignments, questioning whether the dip offers a buying opportunity or signals deeper correction. Gold – Euphoria, Crash, Consolidation.

1. Review – Between Euphoria and Disillusionment

Starting from late October, silver—and eventually gold from mid-December—experienced another rally that accelerated spectacularly in the first weeks of the new year. From USD 4,180, gold prices surged 34% in just seven weeks, reaching a new all-time high of USD 5,602 on Wednesday evening, January 28th. Silver, rebounding from its brief dip to USD 45.51 at the end of October 2025, skyrocketed 167.2% in three months, peaking at USD 121.67.

Gold/Silver-Ratio, weekly chart as of February 18th, 2026. Source: Tradingview

After silver’s spectacular and increasingly steep rise above USD 121, short-term overheating was evident. Market gravity soon took hold, triggering a sharp correction wave from late January. Gold plunged a whooping USD 1,200 to USD 4,400 in just two trading days, while silver corrected brutally, dropping -43% to a low of USD 64.03 in one week. These sharp pullbacks confirm the classic pattern of speculative excess, driven by rampant profit-taking, exaggerated market euphoria, targeted interventions in futures markets, and drastic margin hikes at COMEX.

Precious metal prices have since recovered notably from their lows over the past two and a half weeks, stabilizing the market sentiment somewhat. Volatility remains extremely high, however, with silver clearly lagging gold. Not surprising, the gold/silver ratio has turned, signaling gold’s outperformance over silver.

Six Months of Extreme Volatility

Overall, the past six months in precious metals markets have been marked by a wild rollercoaster. This cycle of euphoria, exaggeration, and abrupt correction was particularly extreme. While geopolitical tensions, global debt issues, and monetary policy uncertainty fueled safe-haven demand and historic price moves, profit-taking turbulence since late January delivered a sharp reality check.

Unchanged Bullish Fundamentals

Despite the volatility, the fundamental drivers of the secular gold bull market remain largely unchanged. Inflation, high government debt, and central bank policies continue to create tension, driving investors toward real stores of value. Price discovery has increasingly shifted to Asia—especially Shanghai—where physical premiums now significantly influence global prices. Physical silver shortages persist there, harboring potential for renewed price surges.

Healthy Pullback or Speculative Peak?

Against this backdrop, the key question arises: Is the recent correction a healthy consolidation within a long-term bull market—or was the precious metals’ highs merely the result of short-term liquidity flows and excessive speculation?

2. Chart Analysis – Gold in US Dollars

Weekly Chart: Weekly Stochastic Signals Sell

Gold in US-Dollar, weekly chart as of February 18th, 2026. Source: Tradingview

Since the striking triple bottom at USD 1,615 in fall 2022, gold has climbed to USD 5,602—a remarkable 246.7% gain. This massive rise over three and a half years has taken its toll. Notably, silver only gained serious momentum in the final months, supporting the view that January’s new all-time high was likely a key intermediate top within the secular bull market. Silver tends to shine brightest toward the end of upcycles.

After briefly trading far above its Bollinger Band (USD 5,147), prices have pulled back sharply. The middle Bollinger Band has cushioned the sell-off so far. The weekly stochastic has triggered a sell signal, however, and it may take weeks for the oscillator to reach oversold levels after this overextension. Gold still holds firm, oscillating wildly around the round psychological USD 5,000 mark.

Overall, the weekly chart appears mildly bearish, hinting at further correction. In the best case, it mirrors the past two years: The low at USD 4,402 may already be in, followed by consolidation around USD 5,000 in coming weeks or months before the next upleg. Alternatively, a deeper pullback toward USD 4,000ish could be needed.

Daily Chart: Rising 50-Day Line as Key Support

Gold in US-Dollar, daily chart as of February 18th, 2026. Source: Tradingview

Following the weeks-long spectacular rally to USD 5,602, the sharp correction to USD 4,402, and moderate recovery to USD 5,116, the daily chart has calmed down a bit. However, a lower high at USD 5,116 as of last week led to another slide in the beginning of this week.

Nevertheless, gold is posting a series of higher lows at least. And bulls haven’t surrendered the USD 5,000 level, pushing up despite absent Chinese traders. Failure here or at the 61.8%-retracement around USD 5.140 shifts focus to the rising 50-day line (USD 4,652) and lower Bollinger Band (USD 4,648) as support—both trending upward daily, raising odds that the February 2nd higher low at USD 4,655 holds. The consolidation or correction could form a triangle.

The daily chart remains neutral to bearish. Daily stochastic has room to oversold; momentum still points down without much rebound. Expect limited upside during Chinese New Year holidays. The next buy opportunity may emerge around USD 4,700 to USD 4,750, with room for recovery to the upper Bollinger Band (USD 5,344).

3. Commitments of Traders for Gold

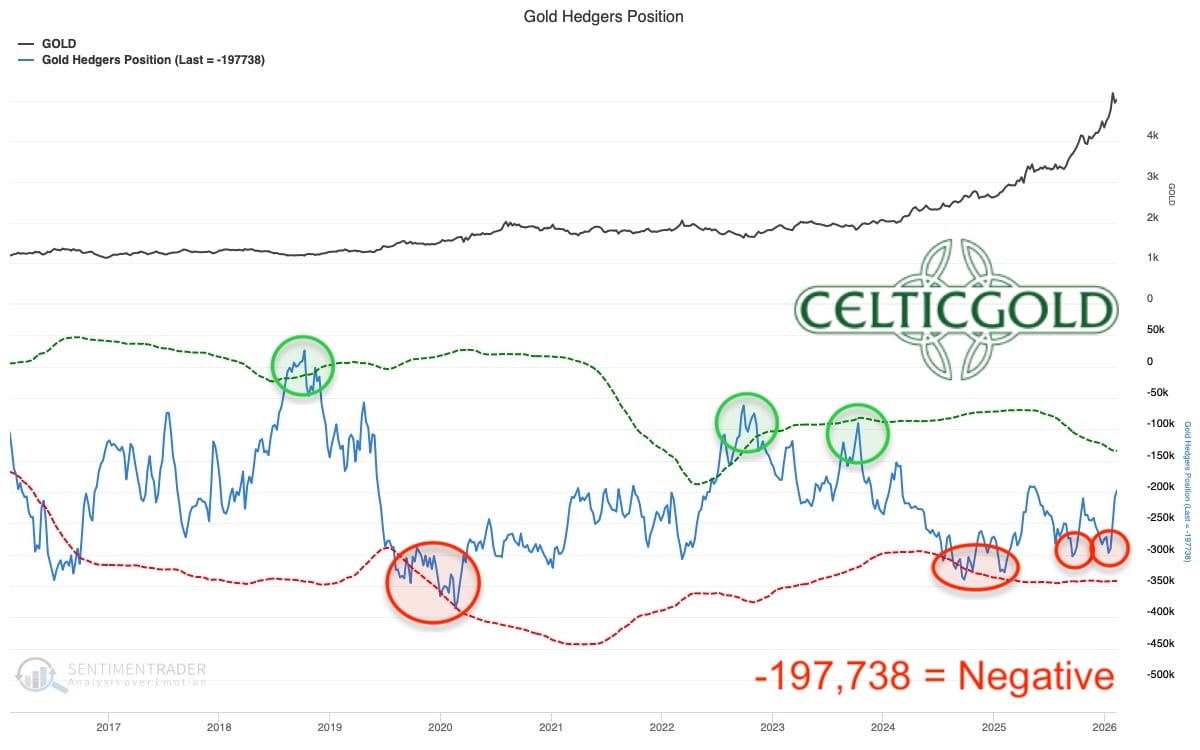

Commitments of Traders Report for gold futures as of February 10th, 2026. Source: Sentimenttrader

As of February 10th at a close of USD 5,052, commercials held a cumulative short position of 197,739 gold futures contracts—high historically but shrunken recently amid the price drop. Bullion banks, hedgers, and producers covered shorts aggressively over the last two weeks.

True contrarian extremes historically occurred below 100,000 contracts. Momentum aligns now, however, and could turn green around 150,000 short contracts given the overall setup.

Based on 22 years of data, the COT remains tentatively negative.

4. Sentiment for Gold – Just another cold shower?

Sentiment Optix for gold as of February 17th, 2026. Source: Sentimentrader

Since spring 2024, gold sentiment data has repeatedly shown overheating, each time cooled by sharp pullbacks that cleared the deck for further gains.

Two and a half weeks ago, Optix signaled extreme optimism again, followed by the expected sharp correction. Now, watch if sentiment stabilizes around 60—or if true panic is needed for the next leg up.

Optix at 64 is neutral. Ideally, it turns up above 55 soon; otherwise, an extended correction grows likely.

5. Seasonality for Gold – Green lights into spring

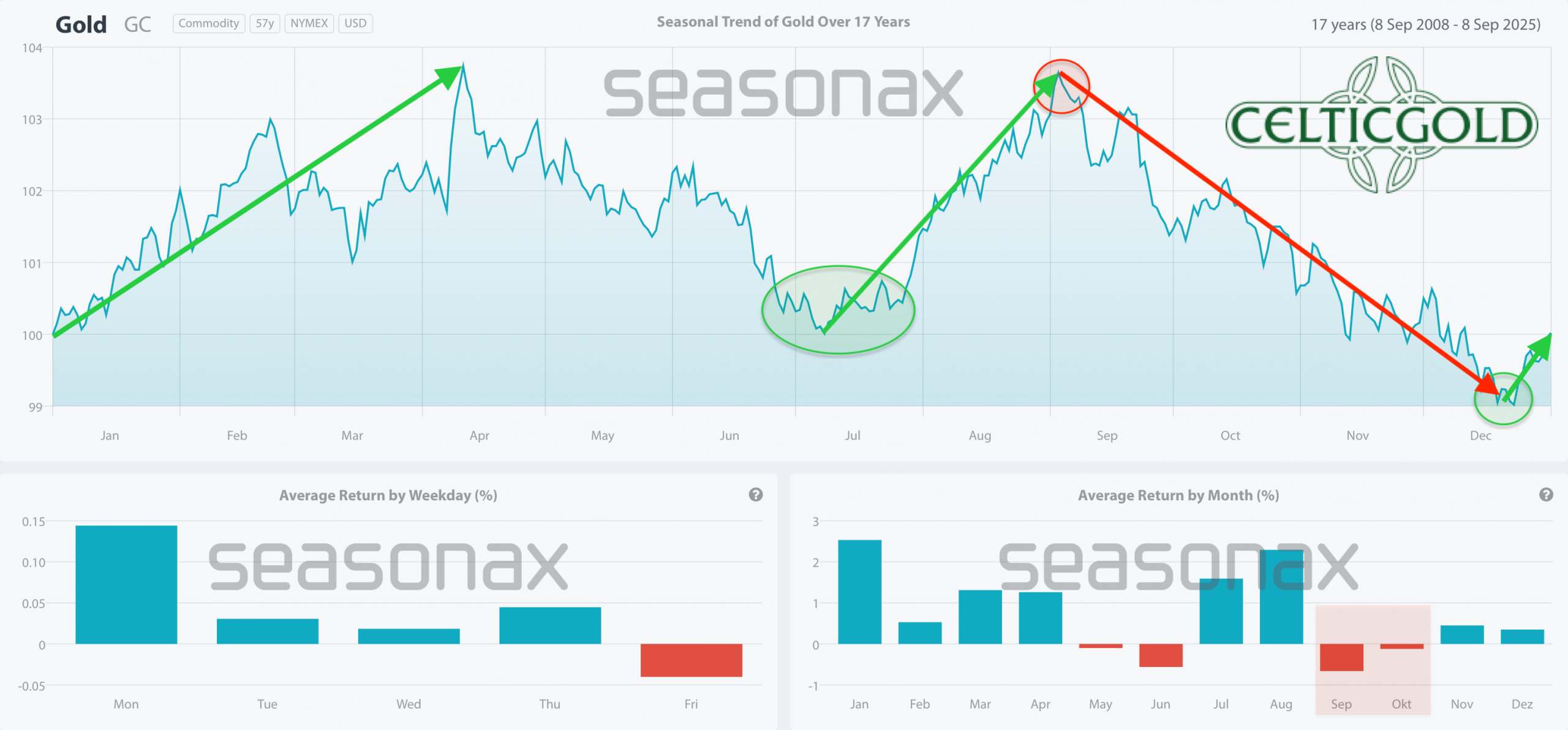

Seasonality for gold over the last 17-years as of September 8th, 2025. Source: Seasonax

Seasonality for gold over the last 17-years as of September 8th, 2025. Source: Seasonax

As expected, gold rallied from mid-December. The January 28 new all-time high and trend reversal came earlier than seasonal norms. But the sector remains in a favorable seasonal phase through March/April. Odds favor at least a solid recovery rally in the next two months.

Drastically higher all-time highs until early summer aren’t seasonally supported though – the window is narrowing. Either gold recovers to USD 5,150 to USD 5,350 by April/May and consolidates above USD 5,000 into summer, or can directly attack USD 6,000. Next contrarian buy window should come somewhere between June and August.

For now, the seasonal light stays green through at least March.

6. Macro Update – Global Power Shift

The global economy is undergoing its most profound transformation in decades. While China aggressively architects a new world order, the United States finds itself mired in a phase of profound internal instability and division. Persistent budget battles—complete with government shutdowns—intraparty fractures under President Trump, swirling corruption allegations, arbitrary dismantling of federal agencies, controversial tariffs, foreign policy isolationism, and a staggering deficit explosion exceeding USD 34 trillion have severely hampered the U.S. administration’s ability to act decisively, all while the midterm elections on November 3rd, 2026, loom as a direct threat to Republican majorities.

China’s AI Dominance

In stark contrast, China is executing the most ambitious industrial policy since the Marshall Plan. Just last weekend, five leading Chinese AI firms—Zhipu, ByteDance, Alibaba, Moonshot, and DeepSeek—simultaneously announced major model upgrades, with their systems costing roughly one-sixth to one-quarter as much as their American counterparts. Meanwhile, the U.S. debates fresh tariffs after pouring USD 380 billion into AI infrastructure with scant measurable returns.

China is not merely catching up; it is actively supplanting the Western “tech stack.” The “Four Dragons”—Moore Threads, MetaX, Biren, and Enflame—have recently gone public or reached IPO readiness, Huawei is doubling production of its Ascend chips to 600,000 units annually while plotting to surpass Nvidia, and Bernstein forecasts that U.S. export curbs will slash Nvidia’s China market share from 40% to 8%, potentially elevating Huawei to 50%. Beijing is mobilizing USD 70 billion in chip subsidies and mandating that state telecom firms replace AMD and Intel components by 2027.

Energy Transition as Growth Engine

China is also advancing with strategic foresight in the energy sector, aiming squarely for global leadership. Last year alone, it invested nearly USD 1 trillion in clean energy—four times more than in fossil fuels—a move that likely propelled about one-third of its GDP growth. The country now generates a terawatt of solar capacity annually, commands 70% of global EV production (with nearly half of all new cars worldwide being electric vehicles), and uses this to power its own AI data centers with affordable renewables. The U.S., by comparison, remains mired in debates over wind subsidies, even as China single-handedly installed 277 gigawatts of solar in one year.

Gold as Strategic Reserve

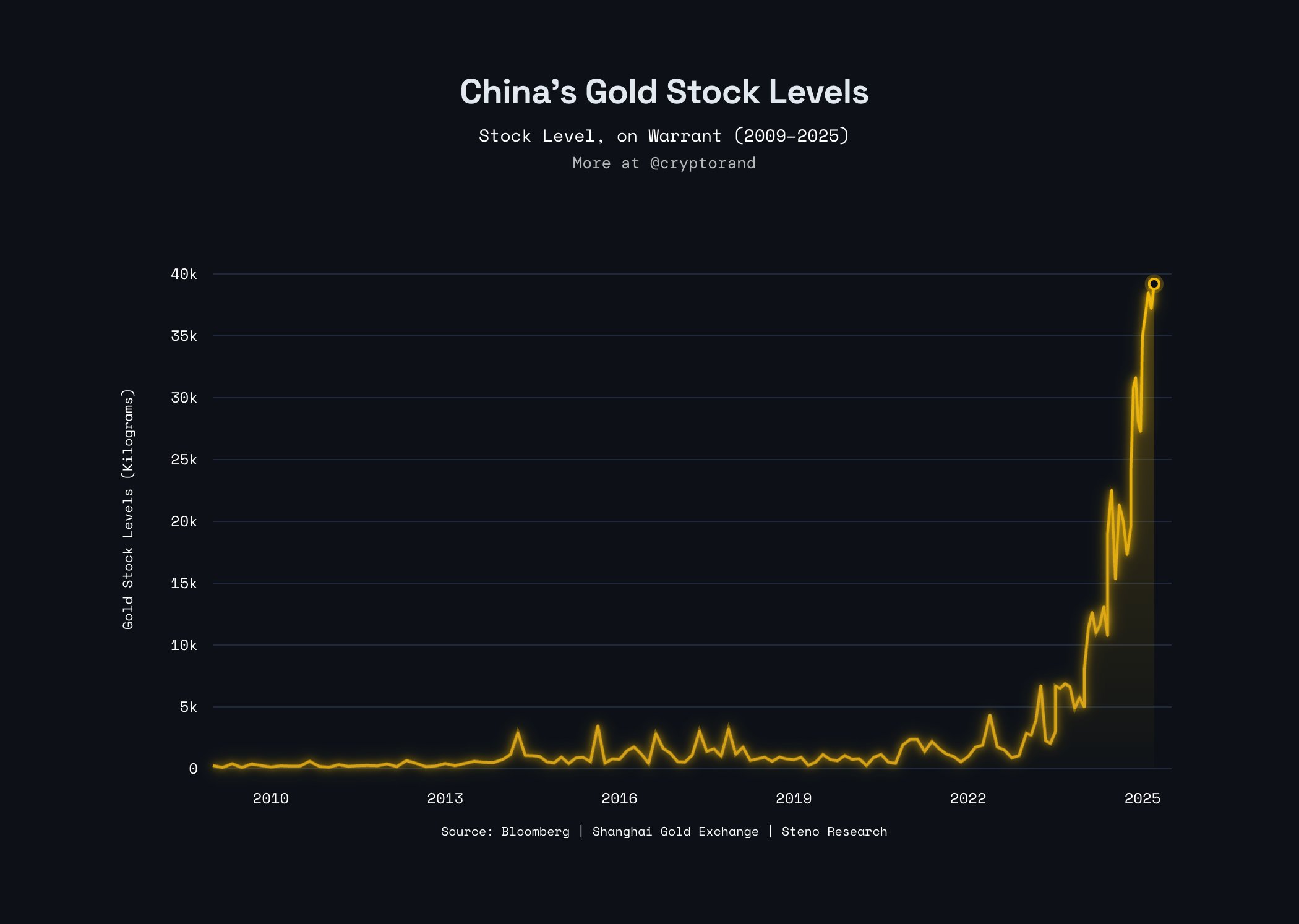

China’s Gold Stock Levels as of February 17th, 2026. Source: @cryptorand

China remains steadfast in its long-term financial strategy as well. Its central bank, the People’s Bank of China (PBoC), has been steadily accumulating gold for years; in January alone, official reserves swelled by another USD 51 billion to USD 369.6 billion, though the World Gold Council estimates the true holdings are double that figure.

Beijing is further diversifying commodity price discovery by expanding its official gold reserves to 2,308 tonnes and scaling up renminbi-denominated gold contracts through the Shanghai Gold Exchange. Yuan trade with nations like Saudi Arabia, Brazil, and Indonesia is surging, underpinned by record exports of USD 3.77 trillion and a surplus of USD 1.19 trillion.

U.S. Treasury Drawdown

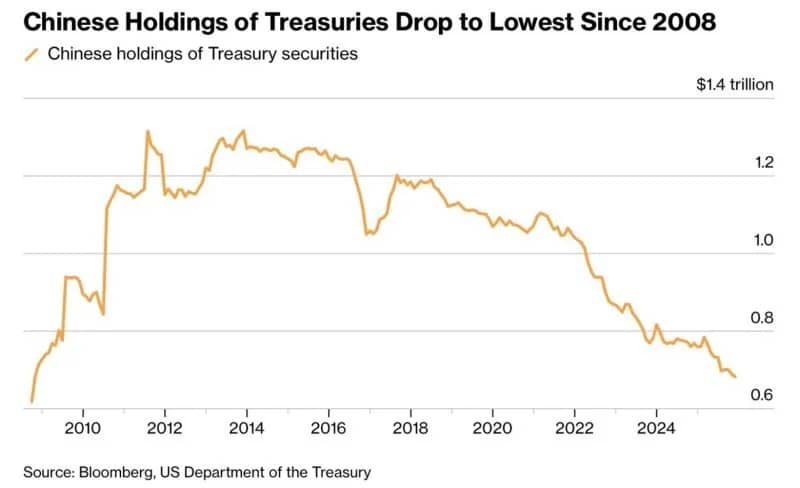

Chinese Holdings of Treasuries as of February 16th, 2026. Source: Bloomberg, US Department of the Treasury

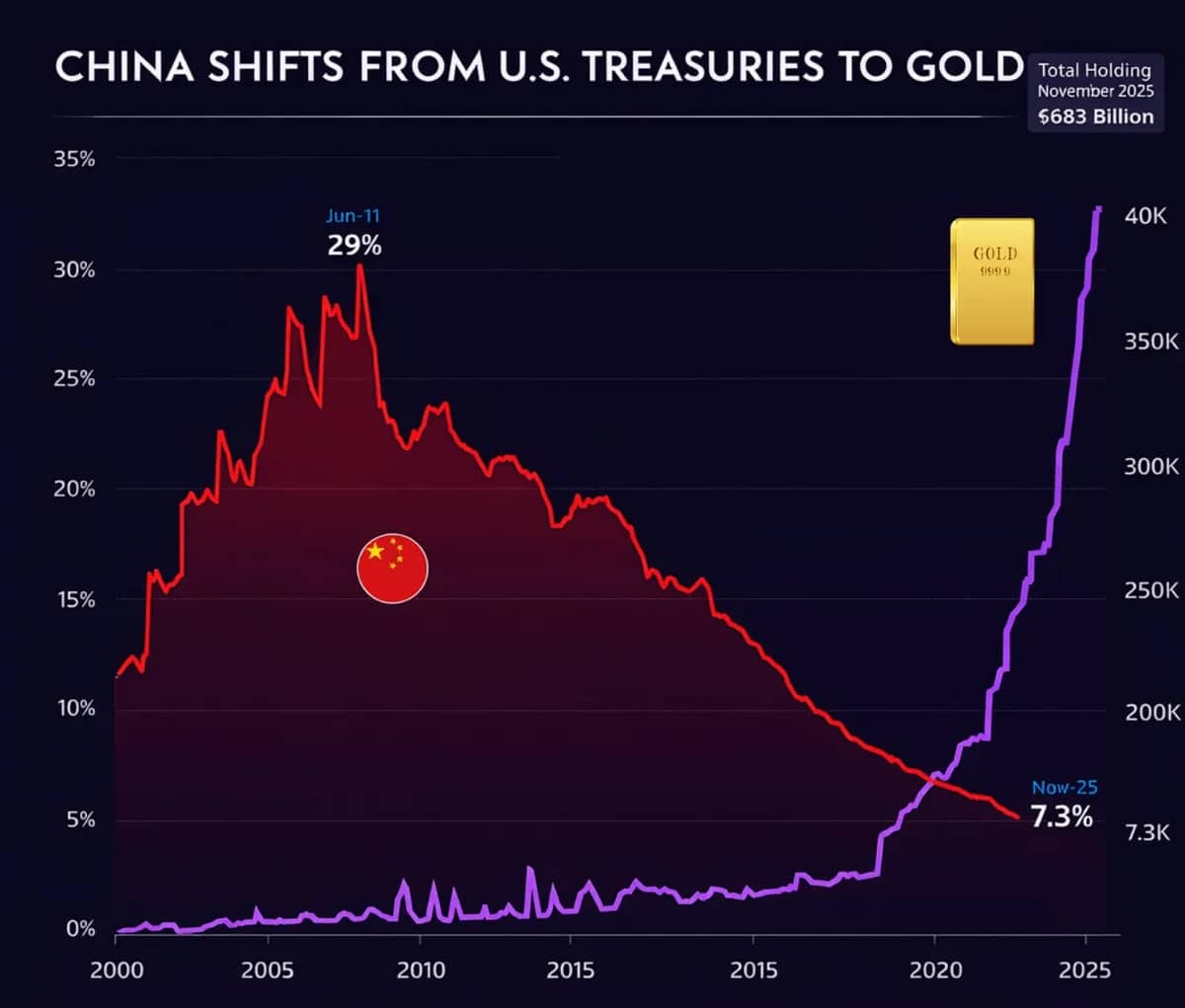

At the same time, China has dramatically slashed its U.S. Treasury holdings from USD 1.32 trillion to just USD 683 billion—the lowest level since 2008 and now a mere 7.3% of its total reserves, down from 28.8% in 2011. The trajectory is unmistakable: a deliberate pivot from U.S. Treasuries toward gold.

Yet the narrative of de-risking and a post-dollar world overlooks Beijing’s desperate liquidity juggling act amid 11 straight quarters of GDP deflation, 40 months of negative producer prices, a brutal property crisis eroding domestic demand, and relentless capital flight. These Treasury sales are about propping up the yuan, managing liquidity, and dodging Russia’s fate of overnight frozen overseas assets.

Energy Dollar Trap

The most inescapable chain persists, however: China cannot break free from dollar-denominated energy imports. It guzzles about 11 million barrels of crude oil daily—covering roughly 70% of domestic consumption—and LNG imports are projected to hit 140 million tons annually by 2030 as it phases out coal for air quality and CO2 reduction goals.

Virtually all these hydrocarbon imports are invoiced in U.S. dollars. While China has inked some yuan deals with Russia, they cover less than 20% of the total; the rest—Saudi crude, Iraqi oil, Angolan crude, U.S. LNG, Qatari LNG, Australian LNG—is billed in dollars. Thus, the dollar remains indispensable to China’s energy transition, trapping it in a cage forged from methane and oil molecules coursing through pipelines, terminals, and tankers, every transaction settled in USD.

China’s Treasury reductions thus prove no sign of dollar weakness but rather underscore the urgent, calculated stewardship required to navigate an economy where the U.S. dollar remains unavoidable.

Dollar Dominance via Infrastructure

Accordingly, China can hoard gold and ink yuan swap lines with Argentina or Saudi Arabia for headlines all it wants—but when an LNG tanker docks in Ningbo or an oil supertanker pulls into Qingdao, the bill arrives in dollars.

The U.S., conversely, does not just produce energy; it controls the global flows, enforcing a durable dollar dominance that even deep Treasury markets cannot match. This command over energy streams is bolstered by America’s own energy abundance, military supremacy, and profound financial markets.

China Shifts From U.S. Treasuries To Gold as of February 16th, 2026. Source: Giacomo Prandelli

China’s Treasury sales thus serve primarily liquidity management, not a bid to trigger a dollar collapse. The U.S. responds to its demographic shrinkage and colossal debt piles with quantitative easing and fiscal dominance.

Gold: Eternal Anchor in the AI Age

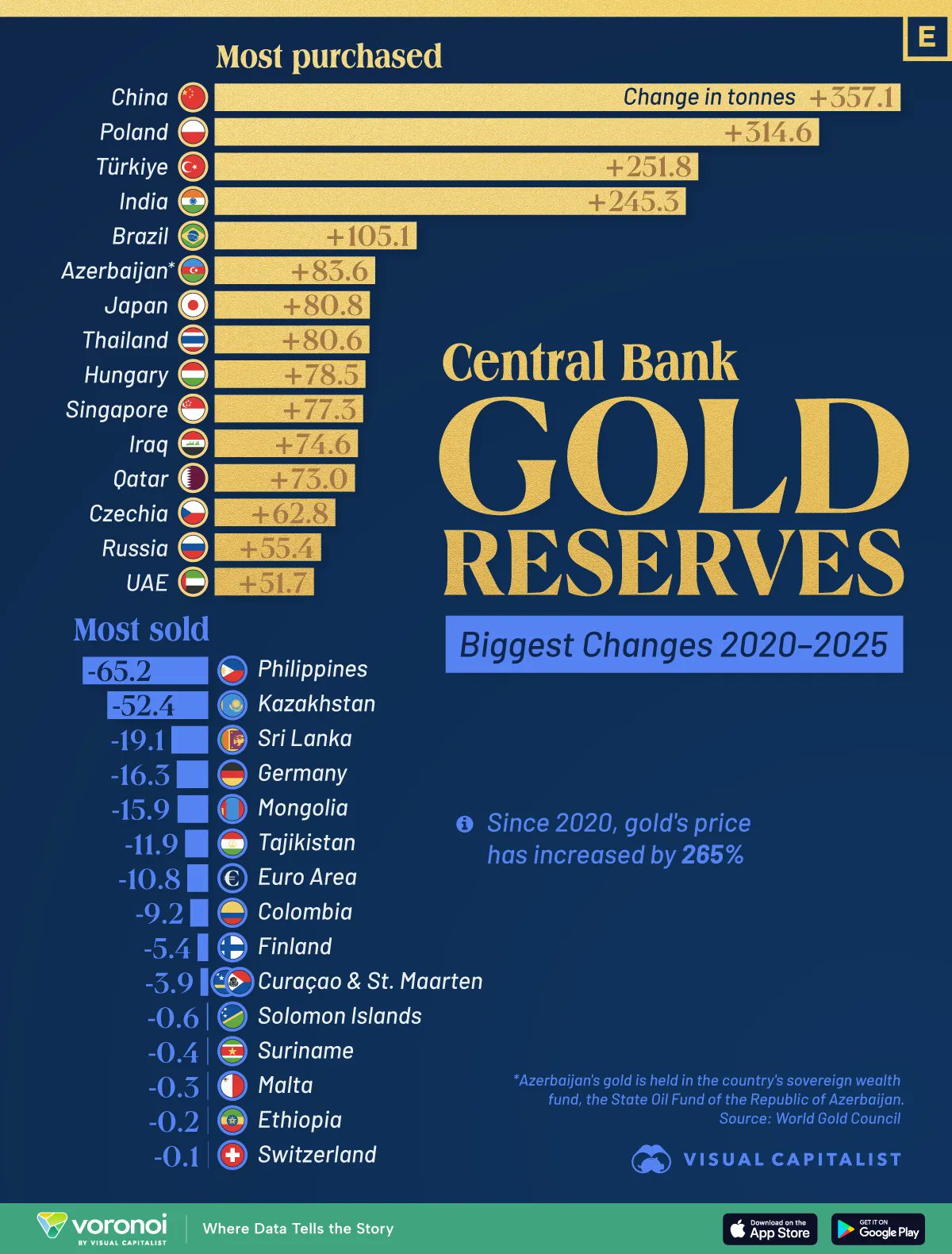

Central Bank Gold Reserves as of February 15th, 2026. Source: mining.com

All these developments remain quite bullish for gold prices, as not only China’s central bank but also Poland, Turkey, and India relentlessly build reserves, forging a structural price floor. Though the recent rally stalled at USD 5,602—a significant peak—gold endures as the premier safe-haven asset amid tectonic global power shifts, geopolitical frictions, and persistent central bank buying that underpins prices long-term.

In the future, robots and AI will define our lives. Demographics and debt will stifle organic growth, channeling capital into software and networks. True values will gain primacy: Intelligence will detach from human labor, autonomous AI agents will supplant traditional demographics to enable expansion without population growth or jobs, meaning will become the scarcest resource, creativity and authentic connections will take center stage, and machines will refine intelligence—freeing humans, ideally, to reclaim their lives.

Here, gold proves indispensable as an anchor, for while fiat currencies erode under exponentially mounting debt mountains and algorithmically spawned liquidity, gold stands alone as the asset that cannot be infinitely replicated.

Its scarcity is geologically inscribed—not politically bargained or digitally rewritten. In a world where nearly every scarcity dissolves via autonomous agents and exponential computing, the engineered absence of scarcity emerges as the core risk.

Gold inverts this logic: It embodies scarcity by definition. The more prosperity turns immaterial, networked, and replicable, the more balance sheets and psyches crave an anchor beyond digital control—physical, decentralized, ancient, and future-proof. Gold is thus not merely a store of past value but a forward-looking shield against the devaluation dynamics of a post-demographic, hyper-productive yet inflation-vulnerable civilization, and an unshakeable rock amid geopolitical tempests.

7. Conclusion: Gold- Euphoria, Crash, Consolidation

Once again, the wild rollercoaster ride of precious metals prices exemplifies the classic dynamic of speculative overheating followed by a healthy correction within a secular bull market. Even though silver in particular has been brutally crushed, we see absolutely no reason to declare the end of the overarching upward trend.

Recovery into spring towards approximately USD 5,350

On the contrary, in the best-case scenario, the lows may already be behind us, and gold could effortlessly recover to around USD 5,350 by late spring. Alternatively, the correction might drag on a bit longer and more stubbornly. However, prices significantly below USD 4,000 remain statistically and structurally improbable at this juncture.

Fundamentals: An Indestructible Base

While technical charts currently suggest a further phase of sideways movement or mild downside, the fundamental drivers form an almost indestructible foundation: Asia’s insatiable hunger for gold, persistent physical supply shortages, geopolitical power shifts, and the strategic purchases by major central banks (led by China) provide enduring support for the long-term trend. Adding to this is the traditional seasonal tailwind, which typically delivers noticeable upside momentum through April.

In an era defined by global power realignments—China’s systematic gold accumulation, an AI-driven productivity explosion, the energy transition, and simultaneous structural instability in the US dollar sphere—gold remains the ultimate, irreplaceable anchor for preserving real value.

Scarcity’s Paradoxical Power

Its geological scarcity paradoxically gains dramatic relevance in a world where nearly every other form of scarcity is dissolving through exponential computing power and autonomous AI agents. As meaning and authentic, unadulterated human connections become the scarcest resources, physical gold emerges as a shield against the devaluation dynamics of a hyper-productive yet fiat-inflation-prone civilization.

Dollar Trap Bolsters Gold’s Appeal

The dollar-energy trap continues to bind even strategic players like Beijing to the realities of the fiat system—and thereby paradoxically amplifies gold’s role as a protector and diversifier. Precisely for this reason, a clear overweight position in precious metals in the portfolio remains fully justified.

Investment Strategy: Buy the Dip

Disciplined investors stay fully invested in physical metals and treat every genuine pullback for what it is: a rare buying opportunity presented by the market within an intact secular uptrend. We already see the next entry point in the USD 4,700 to USD 4,750 range.

“February 19th, 2026, Gold – Euphoria, Crash, Consolidation” – analysis was initially published on February 18th, 2026, by www.celticgold.de and translated into English on February 19th, 2026.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.

Disclosure:

This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.