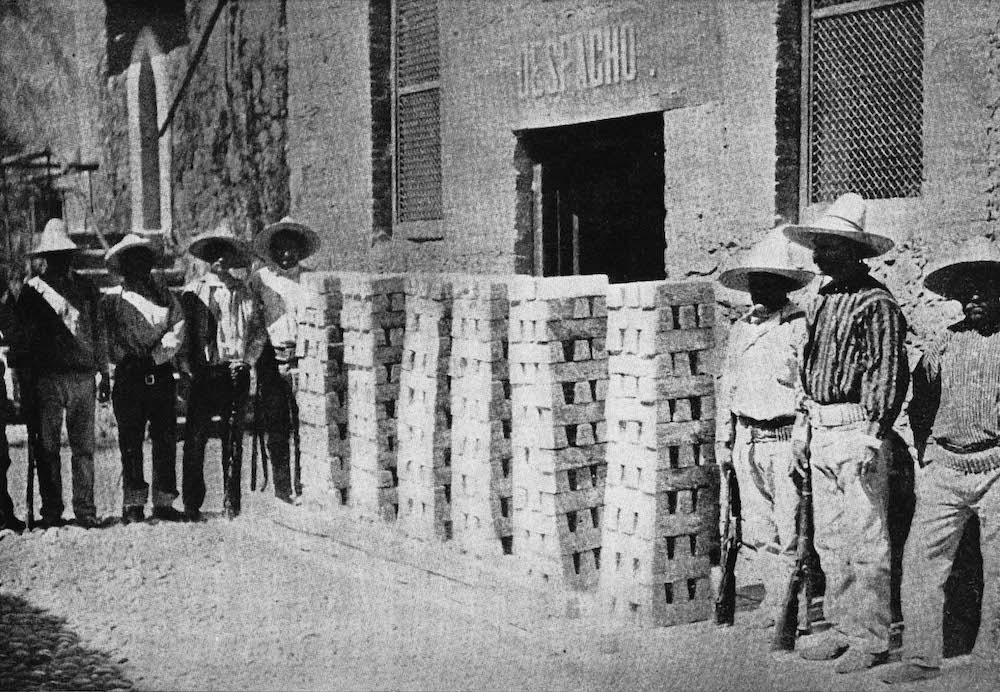

When the Spanish Conquistadors overthrew the Aztec Empire in 1521, they were bent on plundering its stores of gold, but in the process they unexpectedly found something far more valuable.

The Spaniards’ greed had been inflamed by the sight of lavish golden ornaments in the palace of the emperor Moctezuma, which stood on the site of modern-day Mexico City. To their disappointment, many of these turned out to be gold-plated copper. However, they soon discovered that the region was home to the largest and richest silver deposits the world had ever seen.

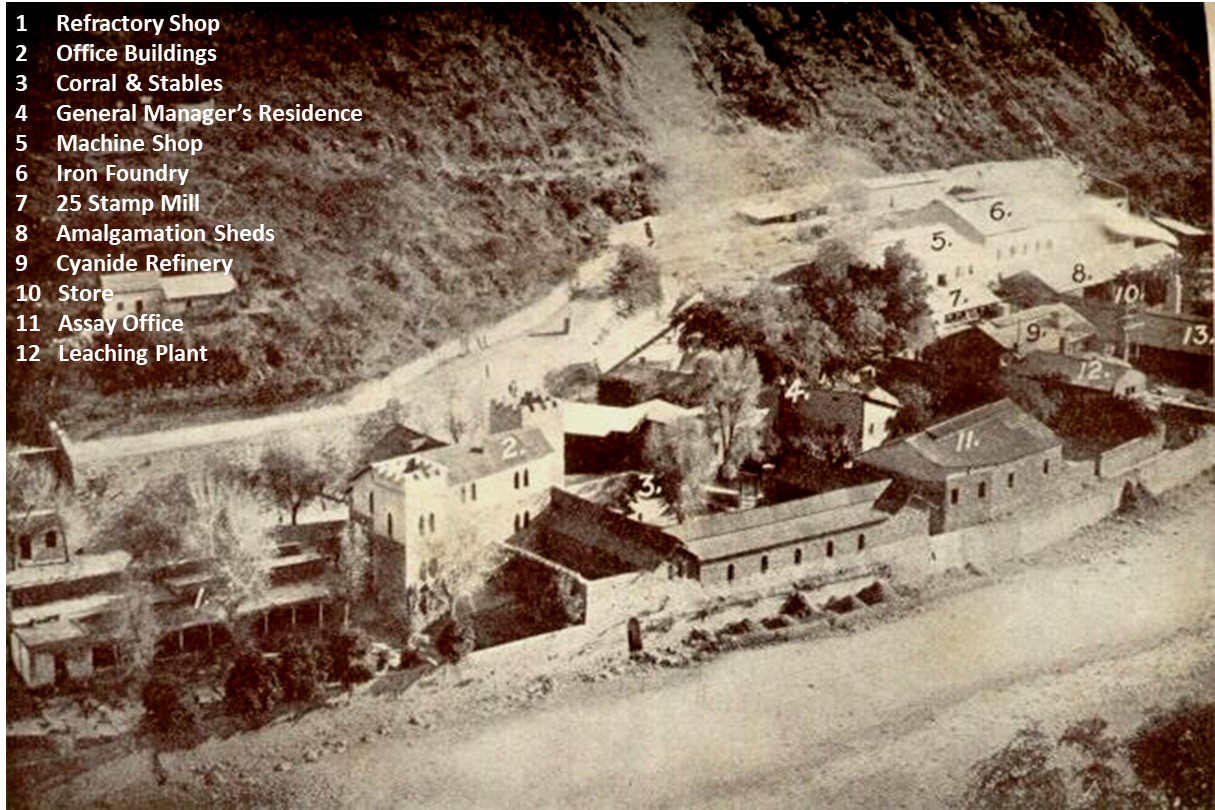

Soon, dozens of mines powered by slave labour were producing hundreds of tons of the precious metal a year, and the flow of this wealth from the Americas back to Spain would transform it into the wealthiest and most powerful country in the world.

Today, most silver is extracted as a by-product of mines scattered around the globe targeting other metals such as gold, copper, lead and zinc. But when it comes to large, high-grade silver deposits, Mexico remains head and shoulders above the rest, and it is home to 8 of the 15 districts worldwide that have produced more than a billion ounces of silver.

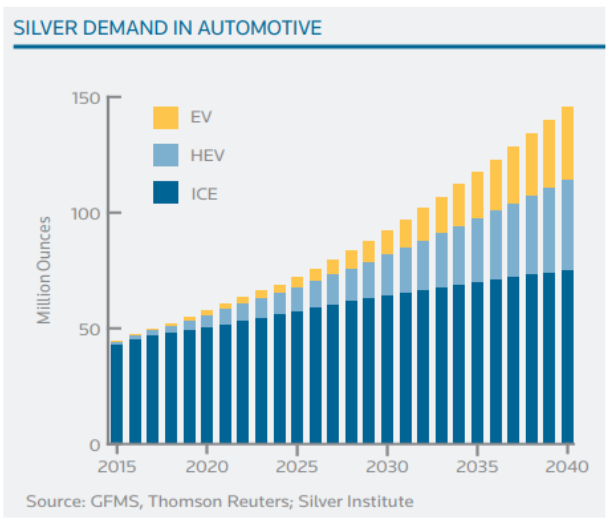

Yet scientists believe much of the nation’s silver wealth still lies underground, in huge rich deposits that have yet to be pinpointed. With industrial demand for silver soaring on the back of modern technologies including solar panels, electric vehicles and 5G networks, the race is on to find them.

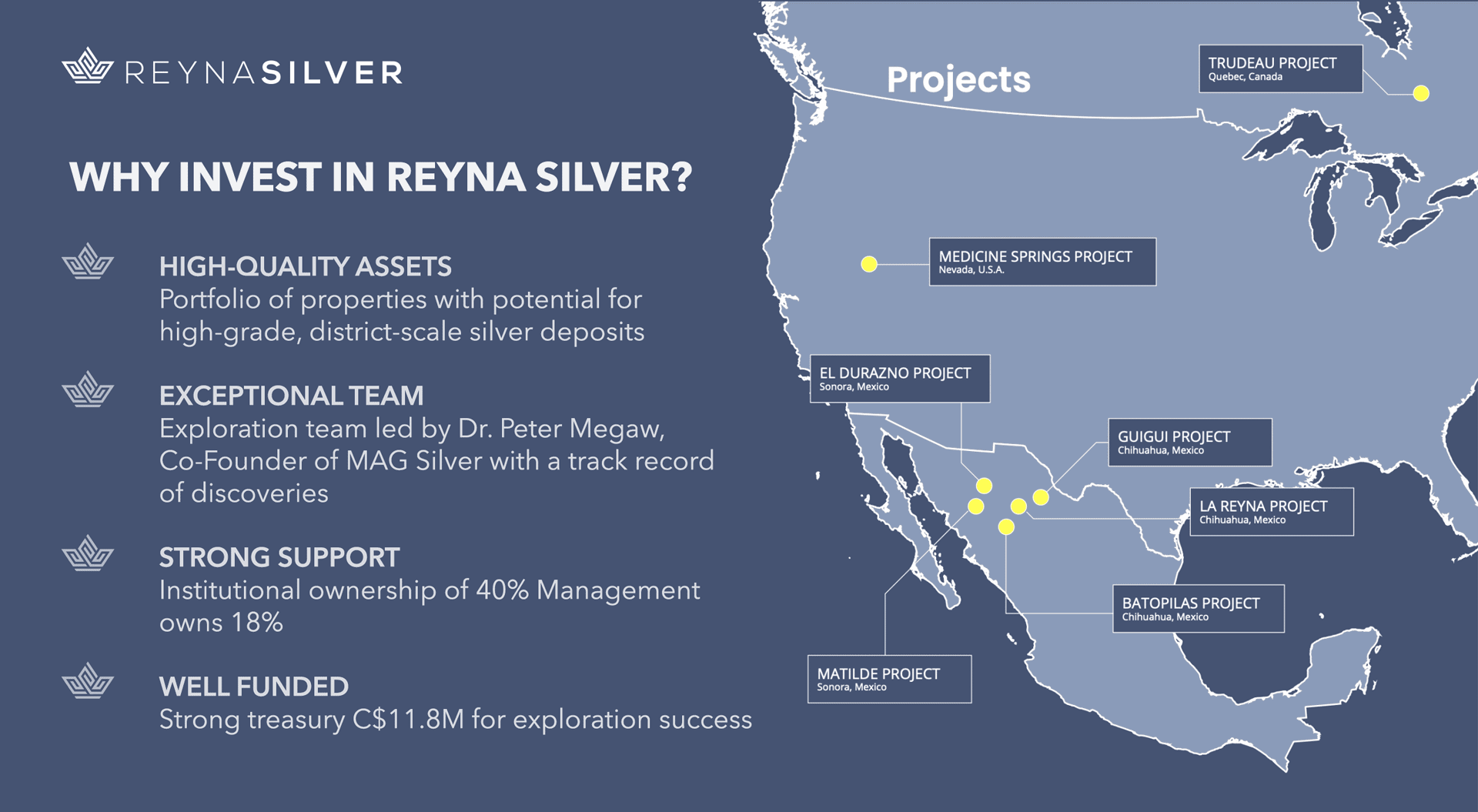

Geologist Peter Megaw heads the exploration team of Reyna Silver Corp. (TSXV: RSLV, OTCQB: RSNVF; FRA:4ZC), a company newly listed in 2020 to target several exciting silver prospects across Mexico and the southern US.

“The fundamental reality of silver mining history is that until about 30 years ago, pretty much all discoveries were made based on what we call outcrops, where the rocks stick up out of the ground,’’ says Megaw.

“The first blind discovery in Mexico – a blind discovery is what we call it when you find something that has no surface expression at all – was only made in 1996. But thanks to advances in the sciences of plate tectonics and geophysics we have now come to understand how these big deposits were formed, and how to predict their locations underground. We believe many of those still waiting to be discovered are just as big as, or even bigger than those the Spaniards found, but they are buried deep enough that no one could see them.’’

Megaw is legendary in the world of silver exploration with a host of significant discoveries to his name. These include a Mexican silver deposit he identified 17 years ago which has since proven to be one of the largest and highest-grade in the world.

Owned by Canadian exploration and development company MAG Silver, the Juanicipio silver mine is set to commence production this year and is expected to be the world’s largest by 2023.

With MAG Silver’s management fully occupied by the launch of Juanicipio, MAG opted to transfer several other promising silver prospects to Reyna Silver in return for a significant shareholding.

These include the Guigui project in the north-western Mexican state of Chihuahua, where Megaw is now overseeing an exploratory drilling program for Reyna that he believes has the potential to uncover another massive motherlode of silver.

Megaw is intimately familiar with Guigui: it is where he formulated his PhD during the 1980s, and where he came up with an exploration idea that he has never been able to test on the ground effectively – until now.

“The property was fragmented, there were two or three different owners of mining claims and no one was willing to make the effort to put the land package together so you could explore it as an integrated whole,’’ says Megaw.

“Thanks to a new mining rights acquisition by Reyna Silver last year, we’re finally in a position to do just that so it’s a really exciting time for us. None of our targets there have been explored, but our drill rig started up late last year, and we have an initial 10,000 meters of drilling planned.’’

Megaw is also overseeing the exploration of several other earlier-stage projects for Reyna Silver, including one in the Batopilas district, site of the highest-grade silver deposit ever found in Mexico, and another near Elko, Nevada.

The importance of such a pipeline of prospects becomes clear when Megaw explains that the journey from silver deposit discovery to metal production is a drawn-out process that can take anything from 12 years to as many as 20. It includes the drilling program required to prove that there’s a resource underground worth investing in; securing government permits; negotiating with local communities to ensure they are on side; as well as above-ground engineering, earthworks and construction.

Fortunately, however, early investors don’t have to wait until a deposit is actually in production to reap the benefits of a major silver find.

“If you get involved with an exploration company that makes a discovery then the shares tend to go from a relatively low level in the sub dollar to dollar range, which is where Reyna Silver is trading, to multiple dollars,’’ explains Megaw. “That’s what happened with MAG Silver, where our share price went from $0.10 to $20.’’

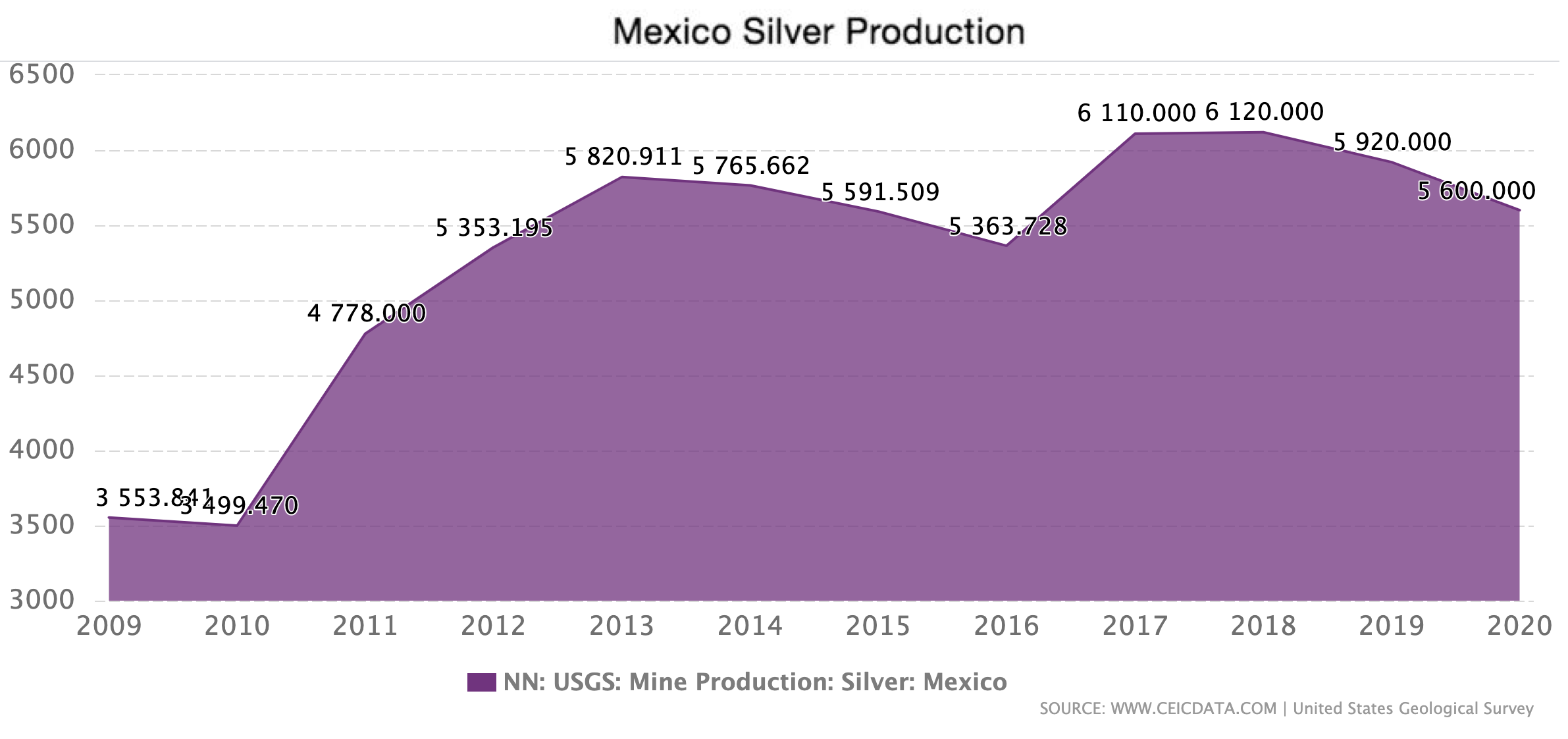

Because most of the world’s silver production today comes from mines for other metals, rapidly ramping up output is not an option. In fact, world production of silver has declined in recent years even as demand has grown.

“You can’t simply decide ‘I’m going to double the production of my copper mine just because I want more silver’,’’ says Megaw. “That has to come from a primary silver source, and there aren’t a lot of those around.’’

That’s because large, high-grade silver deposits are so few and far between, and only high-grade silver mines have the financial resilience to survive the ups and downs of long-term economic cycles.

“Mining exploration investment is a high-risk game, so it demands a high reward for success,’’ Megaw says. “The best way to mitigate against the risks is to focus on high-grade, because what we’re really looking for is a high profit margin that can withstand whatever the world throws at us. That way when silver prices go down, or labour costs go up, you’ve got enough margin that you can make it through.”

“And when you consider that it’s going to take you 15 years to put the mine in production, and if you found something that matters it’s going to be in production for 25 to 50 years, then you really need a mine that can make money even under the worst conditions so even when things are bad you can sleep at night, when things are OK you’re making money, and when things are going really well you’re partying all night.’’

The growth in demand for silver today emanates from several different sources. Globally, manufacturers of hi-tech electronics are heavily dependent on its unique properties: of all the metals, silver is by far the best electrical and thermal conductor, and it is so ductile that it can be flattened into fine sheets and drawn out into super-thin yet flexible wires.

In medicine, silver is attracting increasing attention for its powerful antimicrobial properties, particularly now in light of the COVID-19 pandemic. Silver nano-particles are already incorporated into products ranging from fabrics to soaps to eliminate pathogens, and now research recently published by the US National Center for Biotechnology Information has shown silver to be a “highly potent” killer of the SARS-CoV-2 that causes COVID.

And the precious metal that made the fortunes of the Conquistadors and Spain 500 years ago remains, along with its sister metal gold, as popular as ever for jewellery, coinage, and as a hedge against inflation and a store of wealth in difficult times.

Such a multitude of uses ensures that silver hunters such as Megaw and Reyna Silver will be kept busy for years to come.

To learn more about Reyna Silver please visit https://reynasilver.com

Richard Holdcroft

richard.holdcroft@gmail.com