Bitcoin – Relief rally in the summer?

A worldwide asset price meltdown is shaking up the minds of all investors & traders these days. Nothing seems safe anymore and the crypto sector was hit the hardest. Bitcoin – Relief rally in the summer?

Review

With the clear break of the support around 37,500 USD, the sell-off in the crypto sector intensified dramatically from the beginning of May and bitcoin prices plunged to 25,400 USD within just one week. Despite the already heavily oversold situation at that time, only a tentative recovery or countermovement succeeded afterwards, which already found its end at 32,375 USD.

Starting June 6th, bears went directly into attack mode and pushed bitcoin prices within just 12 days down to 17,600 USD, the lowest level since December 2020. Following this crash, prices are once again only very slowly and tentatively getting back on their feet. So far, they have only managed to recover to 22,400 USD. The bottom line is that bitcoin has lost almost 75% from its all-time high around 69,000 USD on November 10th, 2021.

Ethereum (-81.9%) and the larger altcoins such as Solana (-90%), Polygon (-89.2%), Chainlink (-89.6%), Cardano (-87%) were punished even more severely. The smaller altcoins, however, have almost all lost 90 – 99% across the board.

Brutal wave of bankruptcies

Overall, the crypto sector has been hit hard as the brutal wave of bankruptcies (Lunar, Celsius, Three Arrows Capital, Voyager Digital, BlockFi, Babel Finance, etc.) has been unfolding. The chaotic turmoil has wiped out more than 2 trillion USD in market capitalization and cost thousands of jobs in just a few months. An end to the shakeout is not yet in sight due to the opaque interconnections within the industry and the large number of fraudulent speculators or inexperienced players.

When asset prices collapse or a counter-party defaults on a massive loan, the lender’s balance sheets are left with huge holes. The residual liquidation of collateral then leads to even more loans coming due, which leads to further liquidation of collateral. As a result, numerous trading venues have limited or blocked user withdrawals in recent weeks, further drying up liquidity.

Retail investors who had trusted these lenders to protect their assets or, in particular, to generate high returns have, in some cases, lost everything. Add to this the fear of a global recession accompanied by the worst inflation in more than 40 years. Despite the huge losses, therefore, the end of the storm may not yet have been seen.

Technical Analysis For Bitcoin in US-Dollar

Bitcoin Weekly Chart – Opportunity for a recovery

Bitcoin in USD, weekly chart as of July 13th, 2022. Source: Tradingview

Bitcoin has been in a harsh correction for a little over eight months now. Apart from a somewhat extended rally in February and March, the bulls had hardly anything to offer in terms of resistance. Even the 10-year uptrend line (dark green) was ultimately an easy game for the bears. Now, bitcoin prices cling to the middle line of the overriding uptrend channel. This, together with the completely oversold stochastic oscillator and the previous all-time high around 20,000 USD, forms a certain support, which currently seems to hold.

Overall, the weekly chart is still bearish for now, but the chances of a recovery might outweigh the gloomy picture in the coming weeks. As we know from the past, bear market rallies in bitcoin can be extreme. Realistic recovery targets are around 25,400 USD and maybe 29,750 USD as well.

Bitcoin Daily Chart – Bollinger bands are tightening

Bitcoin in USD, daily chart as of July 13th, 2022. Source: Tradingview

On the daily chart, a consolidation has developed again since the low on June 18th, which could turn out to be a flag formation similar to the ones before. In any case, the low at 17,592 USD was not undercut in the last three and a half weeks. The stochastic still has an active sell signal, but the oscillator has already almost reached the oversold zone.

If the stabilization around 20,000 USD succeeds at the same time, a recovery in the direction of the upper Bollinger band (22,021 USD) and up to the vicinity of the May low at 25,401 USD would be possible.

In summary, the daily chart is currently still bearish. At the same time, some stabilization tendencies are visible between 19,000 USD and 21,500 USD. Together with the relatively large distance to the fast falling 200-day moving average (36,122 USD), there are some arguments for a relief rally in the summer on the table.

Sentiment Bitcoin – Relief rally in the summer?

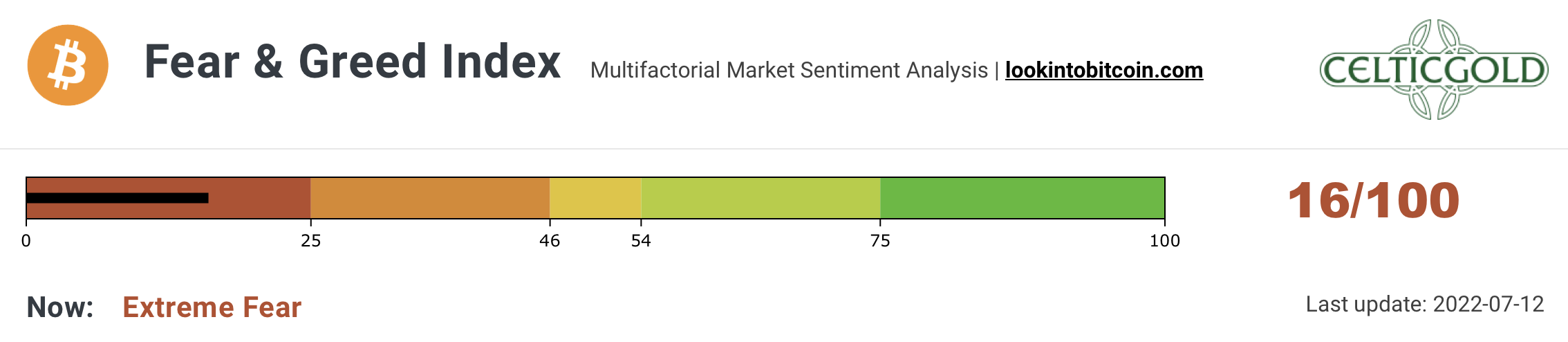

Crypto Fear & Greed Index, as of July 12th, 2022. Source: Lookintobitcoin

The Crypto Fear & Greed Index has been trading in the deep dark red panic zone since the beginning of April, and thus for more than three months now. Hence, fear in the crypto sector runs very deep.

Crypto Fear & Greed Index long term, as of July 12th, 2022. Source: Lookintobitcoin

In the big picture, the current dark red situation in the Crypto Fear & Greed Index resembles the setup from January 2019. Back then, the crypto winter had also hit brutally, and it took almost three months for bitcoin to get a massive recovery rally going. New lows were not seen in the bottoming phase back then.

Overall, the beaten down panic sentiment provides the best contrarian buy signal in over two years!

Seasonality Bitcoin

Seasonality for bitcoin, as of July 11th, 2022. Source: Seasonax

Due to the weak price performance in the first six months of this year, the still young seasonal pattern for bitcoin has weakened or flattened significantly. Nevertheless, according to the statistics, there should be a wave down starting at the end of August, which could possibly run parallel to another sell-off in the stock markets. There, too, September has not earned itself a good name, but is traditionally regarded as the worst month of the year for the stock market. Until mid-August, however, the seasonal outlook does not stand in the way of a small recovery rally in the crypto sector.

Overall, the seasonal component continues to urge patience and caution. The situation should not brighten up until mid/late October from a statistical perspective. A small summer rally, however, would be possible in the coming weeks.

Sound Money: Bitcoin vs. Gold

Bitcoin/Gold-Ratio as of July 12th, 2022.Source: Tradingview

Analogous to the crash of bitcoin, the bitcoin/gold-ratio also fell in recent months and is currently trading around 11.5. Thus, Bitcoin has lost almost 75% against gold since November 2021! At current prices of around 20,000 USD for one Bitcoin and around 1,710 USD for a troy ounce of gold, one has to pay almost 11.5 ounces of gold for one bitcoin. Put another way, an ounce of gold currently costs about 0.085 bitcoin.

Given the strongly oversold situation on the weekly chart near the 78.6% retracement, the chances for a countermovement or recovery are not bad at the moment. In the best case, a retracement to the broken support in the area around 15 to 16 would be conceivable. If bitcoin bears remain in control, however, the ratio could also be pushed directly down to around 5 to 6 in the coming months.

Allocation of sound money

Generally, buying and selling Bitcoin against gold only makes sense to the extent that one balances the allocation in those two asset classes! At least 10% up to a maximum of 25% of one’s total assets should be invested in precious metals physically, while in cryptos and especially in bitcoin one should hold at least 1% but max. 5%. If you are very familiar with cryptocurrencies and bitcoin, you can certainly allocate much higher percentages to bitcoin on an individual basis. For the average investor, who is primarily invested in equities and real estate, a maximum of 5% in the still highly speculative and highly volatile bitcoin is a good guideline!

Overall, you want to own gold and bitcoin, since opposites complement each other. In our dualistic world of Yin and Yang, body and mind, up and down, warm and cold, we are bound by the necessary attraction of opposites. In this sense, you can view gold and bitcoin as such a pair of strength. With the physical component of gold and the pristine digital features of bitcoin, you have a complementary unit of a true safe haven for the 21st century. You want to own both! – Florian Grummes

In summary, the bitcoin/gold-ratio suggests a recovery in favor of bitcoin in the coming weeks. One should not hope for too much given the difficult overall situation, but a rise to around 15 seems possible. While gold often lost out in 2020 and 2021, it was able to fully play out its conservative character this year and is the longed-for safe haven in the portfolio despite slight price declines.

Macro Update – Panic & Recession of 2022

The world is changing faster than ever before. The political landscape is shifting rapidly around the world and becoming more unpredictable by the day. While technology is changing everything we do, tensions in society are increasing in almost every part of the world. Yet, an ounce of gold remains an ounce of gold. Likewise, one bitcoin remains one bitcoin.

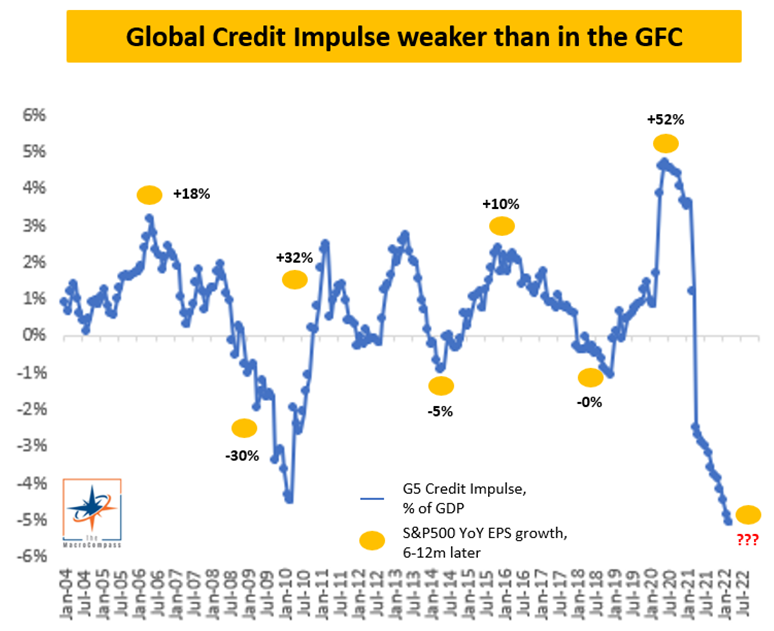

Global Credit Impulse, as of July 7th, 2022. ©The Macro Compass & Alfonso Peccatiello

More than 50 years after Nixon repealed the gold standard, monetary policy has its back against the wall, as the Fed’s fight against inflation could soon plunge the world into a depressive abyss. Just two weeks after the start of its quantitative tightening program, the markets are already behaving like a junkie in withdrawal. Due to massive fiscal pressures as well as hesitant refinancing activity in the private sector, we are now witnessing a contraction in credit creation that is even faster than during the Great Financial Crisis of 2008!

The Fed’s balancing act of fighting inflation without triggering severe dislocations in the markets is therefore doomed to fail. The vehemence of the tightening cycle that has just begun threatens to turn the “Everything Bubble” into an “Everything Crash.”

When will the Fed end its tightening cycle?

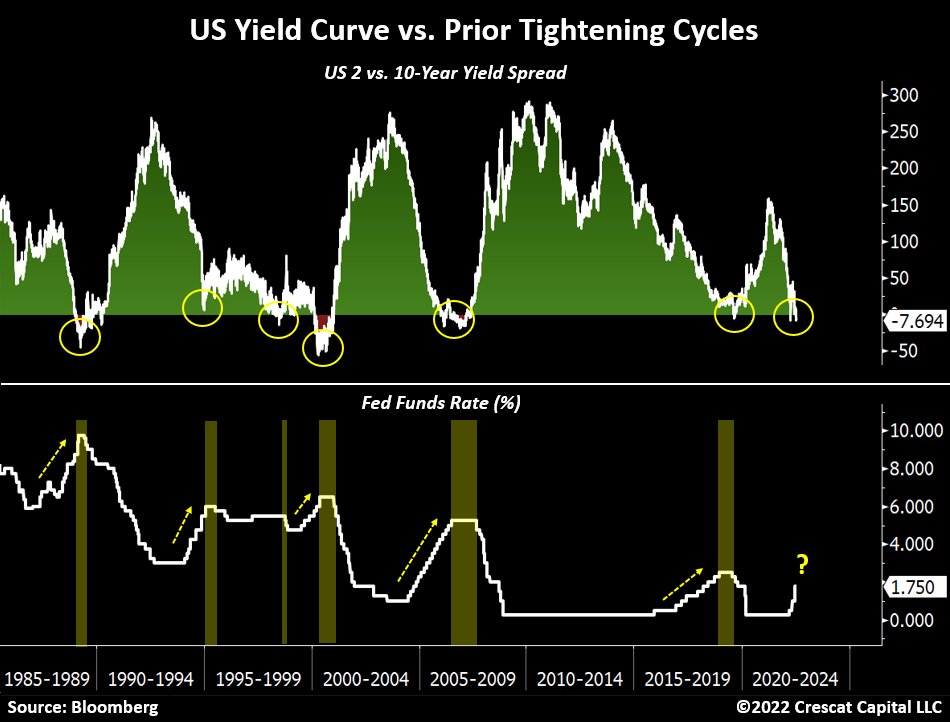

US Yield Curve vs. Prior Tightening Cycles, as of July 12, 2022. ©Crescat Capital & Tavi Costa

It is therefore realistic to expect that US monetary policy will have to deviate from the current hawkish monetary policy stance sooner rather than later and make a U-turn. However, it cannot be ruled out that the FED will once again act far too late. Currently, the yield curve in the US is already turning. In the past 30 years, this constellation has forced the Fed to end its tightening cycle every time. Since the systemic risk is now greater than ever before in history, the Fed can no longer afford to make a wrong decision.

Fed pivot indicator, as of July 11th, 2022. ©TheHappyHawaiian

In fact, some indications now suggest that the FED will have to react soon. With the next rate hike, the FED would presumably and knowingly blow up the financial system. Hence, even the verbal suggestion that rate hikes would be suspended or at least slowed down should therefore be enough at the moment to trigger a summer relief rally in all markets. Likewise, somewhat weaker U.S. inflation data is expected due to the global contraction, which the markets should also take with great relief.

In addition, the U.S. dollar index has had a tremendous ride, rising almost uninterruptedly by a total of +21.25% over the past 14 months. A breather in the U.S. dollar should bring a sigh of relief in the equity, commodity, precious metals and crypto markets. Overall, the chances for a recovery in all markets during the coming summer weeks are therefore not bad. From mid-August or September at the latest, however, the bears are likely to come back.

Conclusion: Bitcoin – Relief rally in the summer?

After a month-long sell-off, including a nasty wave of bankruptcies, bitcoin is currently trading just below 20,000 USD. Eight months ago, very few people would have expected this. Now, however, bullish market participants are rare and numerous experts are coming up with renewed lower price targets for bitcoin. The bitcoin network itself, on the other hand, completely unimpressed by the “Lehman moment” in the crypto sector, continues to process any cryptographically legitimate payments via a computer network of equal computers (peer-to-peer) without any problems.

In the context of the equity markets, which have also seen a severe correction and have correlated strongly with the crypto sector in recent months, a short-term recovery opportunity can be discerned due to the heavily oversold situation. In fact, a summer relief rally towards around 25,000 USD and maybe even close to around 30,000 USD could be possible, especially if inflation declines slightly and the Fed adopts a somewhat milder tone. Nevertheless, the end of the crypto winter is still likely to be a long time away. In any case, prices below 20,000 USD offer a good entry opportunity in the long run. But we believe that a bottom around 10,000 USD is more likely in the next 3 to 12 months.

Analysis sponsored and initially published on July 13th, 2022, by www.celticgold.eu. Translated into English and partially updated on July 14th, 2022.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals, commodities, and cryptocurrencies you can also subscribe to our free newsletter.

Disclosure:

This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.